MicroStrategy Bitcoin Performance Metrics: An In-Depth Guide

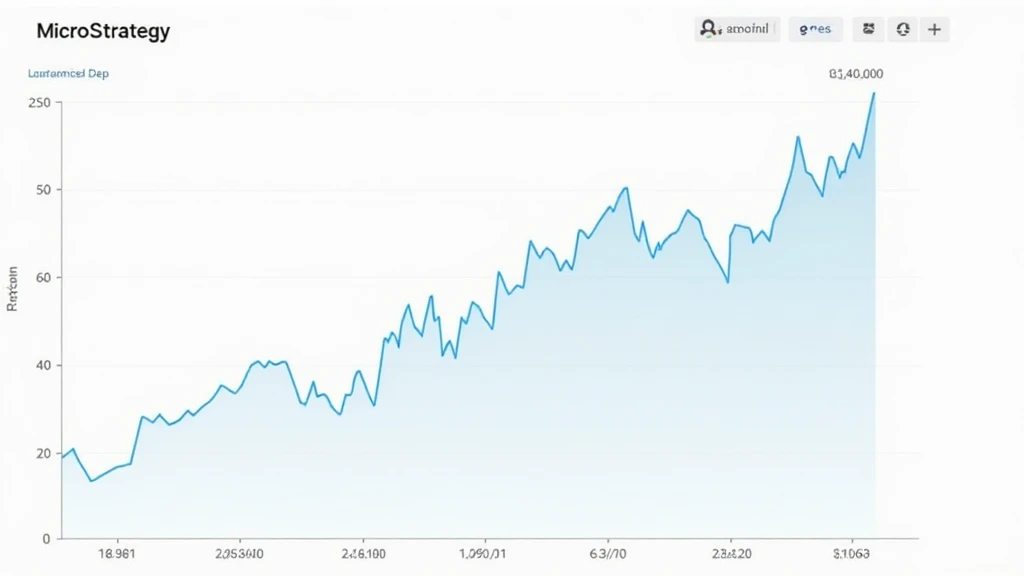

With the rising tide of cryptocurrency investments, companies like MicroStrategy have made headlines by adopting Bitcoin as a significant part of their corporate treasury. As of 2024, the price of Bitcoin fluctuated around $30,000, showcasing both opportunity and risk for investors. What metrics should investors focus on to gauge Bitcoin’s price performance? This article will dive deep into the performance metrics that provide insight into Bitcoin’s value, especially in the context of MicroStrategy’s strategies.

Understanding Bitcoin Performance Metrics

Performance metrics are essential for any investor, but especially so in the volatile world of cryptocurrency. For MicroStrategy, which holds billions in Bitcoin, understanding these metrics is not just beneficial; it’s a necessity.

- Price Trends: Historical price movements, which provide insights into potential future performance.

- Market Capitalization: Total value of Bitcoin in circulation, used to evaluate Bitcoin’s standing in the crypto space.

- Trading Volume: Allows the assessment of market activity and liquidity.

MicroStrategy’s Strategy: A Closer Look

MicroStrategy’s approach involves significant holdings in Bitcoin, leveraging its price performance metrics to inform strategic decisions. The company’s CEO, Michael Saylor, believes that Bitcoin is a hedge against inflation and a digital store of value. According to recent data, MicroStrategy has invested approximately $4 billion in Bitcoin, with an average purchase price significantly lower than current market prices.

Key Metrics MicroStrategy Monitors

To stay ahead, MicroStrategy focuses on several important metrics:

- Return on Investment (ROI): Measuring the profitability of their Bitcoin holdings.

- Cost Basis: Understanding their average purchase price helps in evaluating performance.

- Break-even Price: Essential for determining when to liquidate holdings.

Impacts of Market Changes on Bitcoin Performance

The cryptocurrency market is notorious for its volatility. MicroStrategy’s performance metrics can be influenced by a variety of factors including regulatory announcements, macroeconomic trends, and technological developments. The year 2024 has already seen substantial changes; with Bitcoin’s prices dropping to a low of $25,000 and soaring up to $40,000 within months.

Trends in the Vietnamese Market

Vietnam is experiencing a surge in cryptocurrency adoption, with growth rates nearing 40% in user adoption year-over-year. This has created a vibrant landscape for Bitcoin trading. The Vietnamese market provides a unique lens through which to view Bitcoin’s performance metrics:

- Growing Investor Base: More individuals investing in cryptocurrency leads to increased demand and potentially higher prices.

- Regulatory Developments: Government policies can impact market perception and influence performance metrics.

- Local Trading Volumes: Young investors drive trading volumes, which can affect liquidity and market stability.

Advanced Technical Analysis Techniques

Investors can utilize advanced technical analysis techniques to make better-informed decisions regarding Bitcoin investments. These include:

- Moving Averages: Analyzing price movements over specific time frames to identify trends.

- RSI (Relative Strength Index): A momentum indicator that calculates the speed and change of price movements.

- Support and Resistance Levels: Identifying key levels helps investors make decisions on entry and exit points.

Future Projections for Bitcoin

Looking forward into 2025, industry experts predict that Bitcoin could experience substantial growth, with potential targets nearing or exceeding $100,000 based on current trends, technological advancements, and increasing adoption rates. For investors engaged in crypto assets—especially firms like MicroStrategy—maximizing insights into Bitcoin’s price performance metrics will be critical.

Smart Investment Strategies for 2025

To remain competitive, investors should consider a mix of strategies:

- Diversity in Holdings: Avoid putting all assets into a single cryptocurrency.

- Scheduled Buy-In: Regularly allocating funds for purchases in a disciplined manner to average out purchase costs.

- Staying Informed: Keeping up with news related to market regulations and technological advancements can offer insights that affect performance metrics.

Conclusion: MicroStrategy’s Edge in Bitcoin Investments

In summary, understanding MicroStrategy’s Bitcoin price performance metrics is paramount for both strategizing and managing potential risks within a volatile market. The company’s continuous investment in Bitcoin highlights the importance of adopting analytical tools to interpret market movements and price trends. As the cryptocurrency landscape evolves, so too will the metrics that define success for companies like MicroStrategy.

As we navigate through 2024 into 2025, staying updated with data and performance indicators will be essential. It’s your roadmap within the complex world of digital currency.

For more information on Bitcoin investment strategies, visit hibt.com to explore our resources.

Not financial advice. Consult local regulators.

Author: Dr. Alex Thompson, a blockchain analyst and expert, has published over 50 papers in the field of cryptocurrency and blockchain technology, and has led audits for several prominent blockchain projects.