Introduction

In 2024, the cryptocurrency market witnessed unprecedented growth, with an estimated $1 trillion in capital flowing into various digital assets. Yet, this surge has not been without its challenges, particularly in hardware sales. As enthusiasts and professionals equip themselves for mining, understanding the landscape around NVIDIA crypto mining hardware sales is crucial. With incidents of hardware shortages and rising prices, this article delves into how NVIDIA’s offerings are shaping the mining industry.

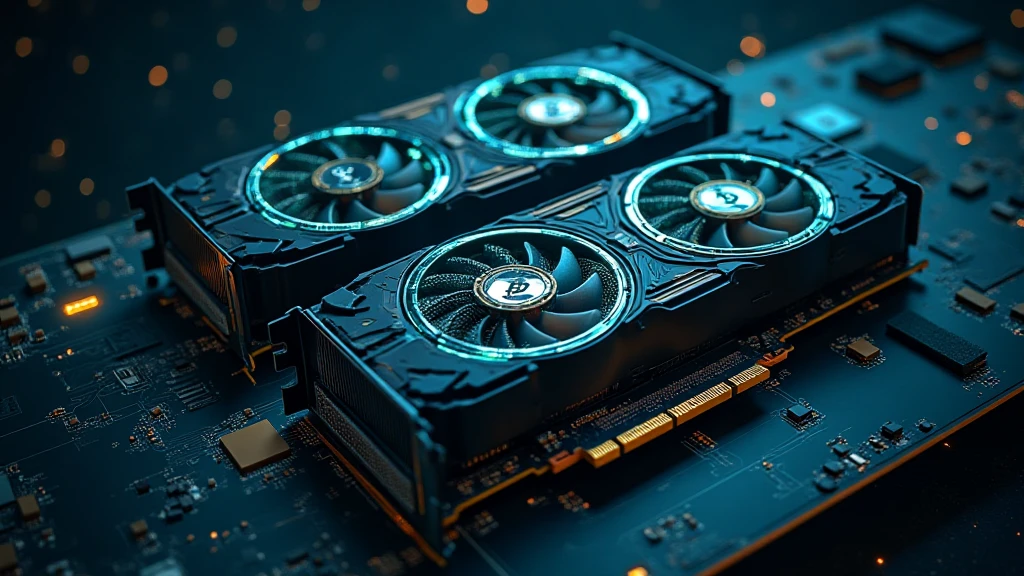

NVIDIA’s Role in Crypto Mining

NVIDIA has established itself as a leader in manufacturing high-performance GPUs, which are essential for mining cryptocurrencies like Bitcoin and Ethereum. These GPUs enable miners to solve complex equations that secure blockchain networks while earning rewards. However, the integration of gaming and mining has created unique market dynamics.

Market Trends in NVIDIA Hardware Sales

Data from Statista shows that in 2025, NVIDIA’s hardware sales are projected to account for approximately 30% of the global GPU market. This trend signifies the significance of their products in the mining community. As more users in Vietnam join the crypto revolution, the demand for reliable mining hardware grows.

- In 2022, NVIDIA launched its RTX 30 Series, optimized for mining.

- The 2023 fiscal year saw a 15% increase in GPU sales attributed to mining, according to company reports.

- Vietnam recorded a 200% increase in crypto wallet users from 2022 to 2023.

Understanding NVIDIA’s Product Lineup

NVIDIA offers a range of products tailored for crypto mining. The GeForce RTX 3080 is popular among miners for its balance of price and performance, while the A100 is geared toward enterprise-level mining operations.

| Model | Hash Rate (MH/s) | Power Consumption (W) | Price (USD) |

|---|---|---|---|

| GeForce RTX 3080 | 90 | 320 | 800 |

| A100 | 200 | 400 | 11,000 |

These products demonstrate NVIDIA’s commitment to addressing the needs of miners, whether they are casual or professional.

The Competitive Landscape of Mining Hardware

While NVIDIA is a frontrunner, it faces competition from other hardware manufacturers. Companies like AMD and Bitmain are also catering to the growing demand for mining equipment, enhancing product capabilities to capture market share.

Comparative Analysis of Top Players

In this section, we compare the top mining hardware manufacturers, examining their strengths and weaknesses.

- NVIDIA: Dominates with extensive support and software integration.

- AMD: Known for lower costs but lacks optimal driver support for mining.

- Bitmain: Focused on ASIC miners, offering superior performance for specific use cases.

Future Projections for NVIDIA and the Mining Market

As we look ahead, the Vietnam crypto market is expected to expand, driven by increased internet access and growing interest in blockchain technology. The 2025 regulatory landscape is also anticipated to evolve, influencing how NVIDIA and its competitors strategize their sales approaches.

Potential Challenges

Despite the positive outlook, NVIDIA must navigate challenges such as:

- Supply chain disruptions affecting shipment schedules.

- Increased pressure from regulatory bodies advocating for energy efficiency.

- Market saturation, with rising competitor offerings that may dilute demand.

Conclusion

In conclusion, NVIDIA’s crypto mining hardware sales reflect a vibrant and dynamic industry poised for further growth. As new technologies emerge and more users, especially in regions like Vietnam, embrace cryptocurrency, NVIDIA’s role will be pivotal. Their ability to innovate and adapt in this competitive landscape will ultimately determine their leadership in the market. For enthusiasts and investors alike, staying informed about these trends and changes is essential for navigating the evolving world of cryptocurrency.

For more insights on cryptocurrency and hardware sales, visit bitcoincashblender.