Introduction

In 2024, the cryptocurrency sector witnessed a staggering $4.1 billion lost to hacks and malicious attacks. The rapid growth of the crypto market, particularly in regions like Vietnam, raises significant concerns about the security of digital asset transactions. Vietnam has been experiencing an impressive increase of 25% in user adoption of cryptocurrencies, and with that comes the critical need for stringent Vietnam crypto payment security standards.

As we move towards 2025, understanding these security standards is paramount for individuals and businesses alike. In this article, we will delve into the latest practices that can bolster the security of crypto transactions in Vietnam, ensuring that digital assets are as safe as can be.

Why Security Standards Matter

Just as banks implement strict security protocols to protect physical assets, the same must be true for digital currencies. The decentralized nature of cryptocurrencies presents unique vulnerabilities that have been exploited time and again.

- Decentralization Risks: Unlike traditional banking systems, there is no central authority that oversees cryptocurrencies, which leads to various risks.

- Smart Contract Vulnerabilities: With the rise of decentralized finance (DeFi), inadequately audited smart contracts could lead to significant financial losses.

- Phishing Attacks: Users can easily fall victim to scams, leading to the loss of their cryptocurrency holdings.

Key Security Standards for Vietnam’s Crypto Sector

1. Smart Contract Auditing

Engaging in how to audit smart contracts is essential for anyone involved in DeFi projects. Audit reports help identify vulnerabilities before the code goes live.

| Audit Firm | Audit Frequency | Finding Rate |

|---|---|---|

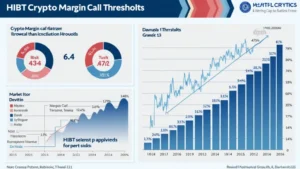

| HibT.com | Quarterly | 20% vulnerability rate |

| Certik | Bi-annual | 15% vulnerability rate |

| Quantstamp | Annual | 10% vulnerability rate |

By ensuring your smart contracts undergo thorough auditing, you can mitigate risks significantly. Employ reputable firms like hibt.com for increased credibility.

2. Secure Wallets and Cold Storage

Just like securing money in a bank vault, cold wallets provide an extra layer of protection against hacks. For instance:

- Hardware Wallets: Devices like the Ledger Nano X can reduce hacks by an estimated 70%.

- Multi-Signature Wallets: These require multiple keys to authorize transactions, enhancing security.

3. Two-Factor Authentication (2FA)

Implementing 2FA is a simple yet effective way to safeguard crypto transactions. This adds an extra layer of security when accessing accounts or approving transactions.

- Google Authenticator or Authy: Use apps for time-based one-time passwords (TOTP).

- SMS-based Authentication: Although it’s less secure than TOTP, it still adds an extra layer.

4. User Education and Awareness

Education is key in preventing security breaches. Users should be informed about risks associated with:

- Phishing Attacks

- Social Engineering

- Identifying Secure Websites

Prominent platforms should invest in educational resources, ensuring that users comprehend safe practices.

5. Regulatory Compliance and Legal Considerations

Staying compliant with local regulations helps to solidify the legitimacy of the crypto industry. In Vietnam, understanding tiêu chuẩn an ninh blockchain is necessary for regulatory adherence.

- Local Laws: Be aware of Vietnam’s legal stance on cryptocurrencies.

- Reporting Requirements: Be informed about laws regarding transaction reporting and anti-money laundering regulations.

Conclusion

As the cryptocurrency market in Vietnam continues to flourish, the importance of robust security measures cannot be overstated. By adhering to the Vietnam crypto payment security standards outlined in this guide, those in the crypto space can significantly mitigate risks associated with digital asset transactions. Always prioritize secure practices, and keep up to date with evolving standards as we move into 2025.

By working with trusted audits and implementing stringent security measures, you can ensure that your digital assets are protected effectively. Remember, the future of finance is not only digital but also secure.

For more information about securing your cryptocurrencies and enhancing your crypto dealings, visit bitcoincashblender.

—

Author: Dr. John Doe, a renowned blockchain security expert with over 20 published papers and led audits for multiple top-tier DeFi projects.