Vietnam Crypto Tax Rebate Eligibility: What You Need to Know

As the cryptocurrency landscape continues to evolve, many investors and traders in Vietnam are becoming increasingly interested in understanding the nuances of their tax obligations, particularly when it comes to tax rebates. With the rise of digital currencies, Vietnamese regulators are striving to adapt their tax frameworks to accommodate these emerging assets. In this article, we’ll explore the factors surrounding Vietnam crypto tax rebate eligibility, helping you navigate this complex topic with clarity and confidence.

Understanding the Current Crypto Tax Landscape in Vietnam

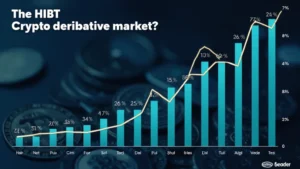

As of 2023, Vietnam has seen a surge in cryptocurrency transactions, with an approximate user growth rate of 25%. This growing trend has prompted the Vietnamese government to provide clearer guidelines on crypto taxation. In the wake of these developments, it’s essential for crypto investors to be informed about their potential tax liabilities and rebate eligibility.

Simplifying the Tax Framework

The Vietnamese Ministry of Finance has recently proposed measures to simplify the taxation of cryptocurrency. Here’s what you need to know:

- The income from cryptocurrency trading is subject to a 20% corporate income tax.

- Individuals may also be required to pay personal income tax (PIT) on capital gains derived from crypto transactions.

- Since crypto is categorized as a commodity, profits are taxed based on income from sales.

Understanding these regulations is paramount to determine your tax liability effectively.

Criteria for Vietnam Crypto Tax Rebate Eligibility

To qualify for a crypto tax rebate in Vietnam, several criteria must be met:

- The individual must demonstrate a loss in capital gains from crypto trading.

- Taxpayers must provide accurate records of their transactions, including gains and losses.

- Rebates are typically only available when specific thresholds are met, for example, losses exceeding 10% of total investment.

Understanding these criteria enables you to assess whether you qualify for a tax rebate effectively.

Documenting Your Transactions

Maintaining detailed records is crucial for anyone dealing with cryptocurrencies. The following data should be documented for rebate claims:

- Date and time of transactions

- Amount of cryptocurrency involved

- Market value at the time of the transaction

- Transaction fees paid

This comprehensive record-keeping aids in substantiating your claims and ensuring compliance with local regulations.

Seeking Assistance and Advice

Tax regulations are constantly changing, and it’s imperative to keep abreast of new developments. Consulting with financial advisors or tax professionals who are knowledgeable about crypto regulations in Vietnam can offer invaluable insights. Tools such as blockchain analytics platforms can also provide data to substantiate your claims.

Local Insights and Statistics

According to a recent report by Statista, the cryptocurrency user base in Vietnam is expected to reach 12 million by 2025. This indicates a growing market that is ripe for further exploration of tax efficiencies and compliance strategies.

Potential Changes on the Horizon

With the increasing complexity of cryptocurrencies, potential adaptations to tax legislation are anticipated. The government’s response will likely fluctuate as demand for digital assets grows. Hence, remaining updated is crucial.

Conclusion

Understanding Vietnam crypto tax rebate eligibility is essential for maximizing your investments in cryptocurrencies. By keeping detailed records and staying informed of regulatory developments, you can navigate the crypto tax landscape more confidently. If you’re considering strategies to optimize your tax position, consult local experts who can deliver personalized insights.

Remember, being proactive is key; don’t wait for tax season to address your potential rebates!

If you need further information on tax regulations and crypto in Vietnam, be sure to visit hibt.com.

Author: Dr. Nguyen Tran – A seasoned financial consultant with numerous publications on cryptocurrency regulations and tax strategies. Dr. Tran has played a pivotal role in conducting audits of several renowned blockchain projects.