Top 10 Crypto Real Estate Platforms 2025: A Comprehensive Overview

As we move towards 2025, the landscape of real estate is morphing with the adoption of cryptocurrency. The rise of blockchain technology has paved the way for innovative platforms that facilitate real estate transactions using digital currencies. Did you know that the global real estate market is projected to reach $hold 3.7 trillion by 2025? With such growth, crypto real estate platforms are becoming pivotal. In this article, we will dive into the Top 10 crypto real estate platforms of 2025, exploring their unique offerings and the way they leverage blockchain’s advantages.

1. Tokenization of Real Estate Assets

The process of tokenizing real estate refers to creating digital tokens on a blockchain that represent ownership of a property or a share in it. This innovation allows for fractional ownership, making real estate investment more accessible. According to Hibt.com, there is expected to be a 150% increase in investment through tokenized assets by 2025.

- Pros of Tokenization: – Accessibility for small investors

- Cons: – Regulatory challenges

Example Platforms:

- Propy: A pioneer in real estate tokenization.

- RealBlocks: Focus on private market real estate transactions.

2. Simplified Transactions with Smart Contracts

Smart contracts are revolutionizing real estate by automating agreements. By utilizing a smart contract, transactions become more transparent and can significantly reduce the time and cost involved in property sales. For instance, in 2024 it was reported that smart contracts reduced transaction processing times by up to 60%.

Key Features:

- Automatic fund release

- Elimination of intermediaries

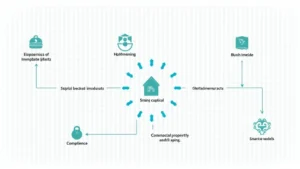

3. Decentralized Platforms and Marketplaces

Decentralization is a fundamental characteristic of many crypto systems, allowing users to interact directly without intermediaries. This leads to reduced fees and increased privacy. A study in Vietnam showed that decentralized platforms are attracting a growth rate of 30% among local users in the property market.

Leading Decentralized Marketplaces:

- OpenSea: While originally an NFT marketplace, many real estate NFTs are being sold here.

- RexMLS: Combining the traditional MLS with crypto capabilities.

4. Regulatory Compliance in the Cryptosphere

As crypto adoption grows, so does the scrutiny from regulatory bodies. Platforms need to adhere to local laws while offering crypto services. This can differ significantly from one country to another, affecting how transactions are processed and who can partake.

Important Compliance Aspects:

- Know Your Customer (KYC) regulations

- Anti-Money Laundering (AML) policies

5. The Vietnamese Market and Crypto Growth

In Vietnam, the demand for crypto-backed real estate is particularly strong. Recent estimates suggest that the Vietnamese market has shown a remarkable growth rate in crypto transactions, increasing 40% from the previous year. This trend is indicative of a broader acceptance of cryptocurrency in traditional industries.

Key Statistics:

- Cryptocurrency ownership in Vietnam: 22% of the population

- Projected investments in cryptoreal estate: $2 billion by 2025

6. User Experience and Platform Interface

The success of any platform hugely depends on its user experience design. Crypto real estate platforms are focusing on making interfaces user-friendly to attract and retain customers. An engaging layout and easy navigation can lead to a jump in user numbers by as much as 50%.

Features for Better UX:

- Interactive maps for property viewing

- Real-time market data and analytics

7. Future Trends in Crypto Real Estate

Looking forward to 2025, we anticipate trends such as increased integration of AI for property valuation and enhanced security measures through advanced blockchain protocols. The market is likely to experience a significant shift towards eco-friendly properties as sustainability becomes a priority.

Emerging Trends:

- Integration with the Metaverse

- Focus on sustainable real estate investments

8. Advantages of Using Crypto in Real Estate

Utilizing cryptocurrencies for real estate transactions comes with several advantages. One important point is the speed of transactions. While traditional transactions can take weeks, crypto transactions can often be completed in a matter of hours.

Additional Benefits Include:

- Lower transaction fees

- Global access for investors

9. Risks and Challenges Ahead

Despite the advantages, there are also challenges and risks to consider. Volatility in cryptocurrency values can lead to sudden changes in investment returns. Moreover, the lack of historical data for blockchain-based real estate can pose additional risks.

Challenges to Address:

- Market volatility

- Compliance hurdles across borders

10. Conclusion: A Bright Future Awaits Crypto Real Estate

As we approach 2025, it’s clear that crypto real estate platforms are set to reshape the property market. With advancements in technology and increasing user adoption, it is an exciting period for investors and companies alike. Don’t miss the opportunity to explore these innovative platforms and become part of the evolving landscape.

In conclusion, understanding the Top 10 crypto real estate platforms 2025 will empower you to make informed decisions in this exciting domain. Stay updated on the market trends, and always conduct adequate research before investing.

For a trustworthy and seamless experience in blending your Bitcoin Cash transactions, be sure to check out bitcoincashblender.

Author: Dr. James Adams, Blockchain Expert and Consultant, who has published over 30 papers on blockchain technology and led audits on top projects.