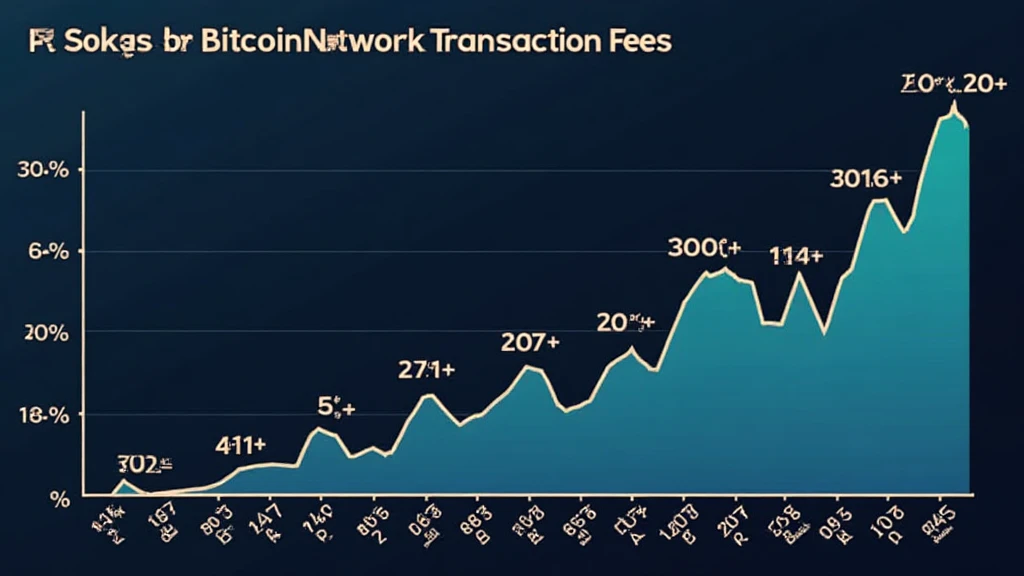

Bitcoin Network Transaction Fee Trends Explained

With the Bitcoin network’s transaction fee fluctuating significantly in recent months, many users are left wondering about the future of these costs and their implications on transactions. As more individuals and businesses adopt cryptocurrencies, understanding the trends surrounding Bitcoin network transaction fee trends is crucial for optimally managing transactions.

The Growing Popularity of Bitcoin in Vietnam

Vietnam is witnessing a booming interest in cryptocurrencies, particularly Bitcoin. Recent statistics indicate that the number of Vietnam’s crypto users has grown by over 300% in the past year, indicating a shift towards digital currencies as a preferred means of investment and transaction.

Factors Influencing Transaction Fees

Various factors contribute to the volatility of transaction fees within the Bitcoin network:

- Network demand: High demand for Bitcoin transactions can lead to increased fees as miners prioritize transactions with higher fees.

- Block size limitations: Each block on the Bitcoin blockchain can only contain a limited number of transactions, leading to competition for space and higher fees.

- Miner incentives: Miners are incentivized to include transactions with higher fees, which can result in fluctuating costs based on market conditions.

Comparing Historical Trends

To better understand the trends in Bitcoin transaction fees, let’s examine historical data. The average transaction fee has seen significant changes:

| Year | Average Transaction Fee (USD) |

|---|---|

| 2017 | $2.07 |

| 2018 | $0.27 |

| 2019 | $0.04 |

| 2020 | $1.85 |

| 2021 | $25.54 |

| 2022 | $0.83 |

| 2023 | $2.14 |

Source: Bitcoin Fees

Western vs. Vietnamese Transaction Fee Trends

Interestingly, the transaction fee trends witnessed in Vietnam often mirror those in the Western markets, albeit with some variations based on local regulations and market adoption rates.

Understanding On-Chain vs. Off-Chain Transactions

Within the Bitcoin environment, there are primarily two types of transactions: on-chain and off-chain.

On-Chain Transactions

On-chain transactions occur directly on the Bitcoin blockchain, impacting the

overall transaction fees. These costs can vary according to network congestion, with users often left calculating the appropriate fee to hasten their transactions.

Off-Chain Transactions

Off-chain transactions, like those through the Lightning Network, offer a solution to alleviating high fees by processing transactions outside of the primary blockchain. Understanding when to utilize off-chain transactions can significantly reduce costs for users.

The Future of Bitcoin Transaction Fees

As the Bitcoin network matures, predicting transaction fee trends becomes essential. Here are some key insights into potential future fees:

- Increased Layer 2 Adoption: As more users begin to utilize Lightning Network and other Layer 2 solutions, on-chain transaction fees may stabilize or decrease.

- Network Improvements: Future upgrades and enhancements to the Bitcoin protocol could lead to reduced fees and faster transactions.

- Market Dynamics: Continuous market fluctuations and adoption of Bitcoin will inevitably influence fee structures.

Conclusion: Navigating Bitcoin Fee Trends

In conclusion, understanding Bitcoin network transaction fee trends is integral to effectively navigating the cryptocurrency landscape. As the market evolves, staying informed about these trends ensures better management of your transactions, whether through on-chain or off-chain methods. As adoption grows, particularly in markets like Vietnam, users can expect fluctuating fees that require strategic planning.

Always consult with trusted sources and stay updated with platforms like hibt.com for the latest insights! Not financial advice. Consult local regulators.