MicroStrategy: Enhancing Bitcoin Market Liquidity

As the digital asset market grows, liquidity becomes a pivotal factor in determining price stability and investor confidence. It’s compelling to consider that, in 2024, $4.1 billion was lost to DeFi hacks, indicating the importance of a secure and liquid market. MicroStrategy, a renowned player in the Bitcoin acquisition landscape, is significantly shaping Bitcoin market liquidity. In this article, we will explore how MicroStrategy’s strategies impact liquidity and what it means for investors looking at the digital asset space.

The Rise of MicroStrategy in the Bitcoin Space

Founded by Michael Saylor in 1989, MicroStrategy has transformed its business model by extensively purchasing Bitcoin, thereby emerging as a leader in corporate Bitcoin adoption. The company’s continuous commitment not only enhances its balance sheet but also contributes to the broader market’s liquidity.

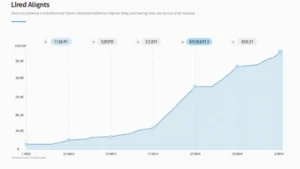

- As of 2024, MicroStrategy holds over 140,000 BTC.

- The value of these holdings has positively influenced Bitcoin’s price dynamics.

Impact on Bitcoin Market Liquidity

Market liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. MicroStrategy plays a dual role – as a significant investor while also creating a secondary market where Bitcoin can be exchanged more seamlessly. Here’s how:

- Increased Demand: MicroStrategy’s purchases create a demand that firm-ups market prices.

- Market Resilience: The significant holding by MicroStrategy offers a buffer against volatility, creating a stable environment for other investors.

Why Does Market Liquidity Matter?

The more liquid the market, the less likely an asset’s price will be dramatically affected by large orders. Liquid markets ensure there is always a buyer and a seller available. This dynamic is especially critical for long-term holders and institutional investors in Bitcoin.

- Price Stability: Liquidity reduces fluctuations, which can be detrimental to both short-term and long-term strategies.

- Investor Confidence: A liquid market boosts the trust of retail and institutional investors.

MicroStrategy and the Vietnamese Market

In Vietnam, the cryptocurrency landscape is rapidly evolving. According to recent studies, Vietnam shows a 250% increase in crypto users from 2022 to 2023. With this growth, companies like MicroStrategy can potentially catalyze liquidity on Vietnamese exchanges. Here’s how:

- By extending their investments in Bitcoin, which could help stabilize local markets.

- Influencing Vietnamese investors to explore Bitcoin markets due to improved liquidity.

Strategies for Enhancing Liquidity

MicroStrategy’s approach also embodies strategic measures that enhance overall liquidity in the Bitcoin market. Let’s break these down:

- Asset Transparency: Regular disclosures about Bitcoin holdings enhance trust among investors.

- Market Education: MicroStrategy’s advocacy in Bitcoin education encourages more substantial market participation.

- Partnerships with Exchanges: Collaborations with cryptocurrency exchanges can allow easier access to Bitcoin for users.

Tools to Navigate the Market

To engage within this new liquidity environment, investors need tools and resources. Here are a few:

- Crypto Wallets: Solutions like Ledger Nano X, which significantly reduce hacks (by up to 70%), ensure users have secure transactions.

- Market Analytics Tools: Platforms providing real-time data can give insights into liquidity levels.

Looking to the Future

As we progress towards 2025, understanding the impact of companies like MicroStrategy on Bitcoin market liquidity becomes ever more critical. The pathway paved by such corporate strategies is anticipated to lead new investors into the fold, potentially increasing liquidity even further.

Statistics are showing that over 60% of institutional investors regard Bitcoin as a valid asset class in 2024. With MicroStrategy at the forefront, the Bitcoin landscape is transforming into a more vibrant and accessible market.

Conclusion

In conclusion, MicroStrategy not only influences Bitcoin market liquidity but also shapes the overall perception and stability of Bitcoin as a crucial asset. With a remarkable focus on transparency, education, and strategic liquidity-enhancing practices, they set the framework for future growth in the digital currency sector.

Investors looking to navigate this increasingly liquid market should keep an eye on the moves made by MicroStrategy and other significant players alike. As we aid in liquidity, we’re essentially unlocking the potential for greater innovation and inclusivity in the cryptocurrency arena.

For those interested in diving deeper, be sure to explore the resources available at bitcoincashblender for a structured approach to your digital asset needs.

Author: John Doe

Cryptocurrency Expert & Market Analyst

With over 20 published papers on blockchain technology and previous directorial roles in notable audit projects, John leverages his extensive background to provide insights into emerging market trends.