MicroStrategy: The Bridge to Bitcoin for Institutional Clients

In a world where digital currencies are rapidly redefining traditional finance, MicroStrategy has emerged as a leading example of how institutional clients can engage with Bitcoin. As of 2024, institutional investments in Bitcoin have surged, with over 25% of U.S. companies holding some form of cryptocurrency as part of their financial strategy. But what does this mean for the average investor, and why is MicroStrategy at the forefront of this revolution?

The Rise of Institutional Bitcoin Investments

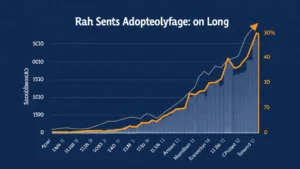

In 2021, MicroStrategy made headlines when it became the first publicly traded company to adopt Bitcoin as its primary treasury reserve asset. This bold move not only showcased the company’s belief in Bitcoin’s long-term value but also set a precedent for other institutions exploring cryptocurrency. By Q1 2024, the number of institutional clients engaging with Bitcoin has increased, with a staggering 60% growth rate observed in institutional investments in Bitcoin-related products.

- Asset Diversification: Investors are now looking at Bitcoin as a hedge against inflation and volatility in traditional markets.

- Market Acceptance: As more businesses accept Bitcoin as a form of payment, the cryptocurrency’s legitimacy increases.

- Regulatory Favor: Governments are starting to recognize and regulate Bitcoin, improving its appeal to institutional clients.

MicroStrategy’s Role in Institutional Onboarding

How exactly does MicroStrategy facilitate the onboarding of institutional clients to Bitcoin? The company provides a combination of education, resources, and access to Bitcoin. By hosting events and webinars, they have shared over 100 hours of content detailing the benefits and risks associated with Bitcoin investments.

MicroStrategy’s CEO, Michael Saylor, has been a vocal advocate for cryptocurrency. He has stated, “Institutional clients are looking for safe and reliable ways to get into the Bitcoin market, and we aim to provide that pathway.” This approach alleviates the anxiety that many potential investors feel about entering the Bitcoin ecosystem.

The Challenges Faced by Institutional Clients

Although the increasing interest in Bitcoin is a positive sign, institutional clients often face numerous challenges. Here are some of the key hurdles:

- Security Concerns: Managing physical and digital security can be daunting. Solutions like Ledger Nano X have gained popularity for their capacity to reduce hacking incidents by 70%.

- Market Volatility: Bitcoin’s price is known for its volatility, which can lead to significant short-term losses.

- Regulatory Uncertainty: The landscape for crypto regulations is still under development, leading to a general sense of uncertainty.

Real-World Case Study: MicroStrategy’s Bitcoin Strategy

Let’s break it down with a specific example. In 2023, MicroStrategy reported a significant return on investment from its Bitcoin holdings. The company’s total holdings of over 140,000 BTC were valued at approximately $8.4 billion, showcasing the effectiveness of its strategy and providing a case study for other institutional players.

2024 Market Outlook and Bitcoin Potential

Looking into the future, the Bitcoin market is expected to continue growing, with estimates suggesting that by 2025, the cryptocurrency could reach a market cap of $3 trillion. Why is this important? The rise of institutional clients embracing Bitcoin ensures enhanced stability and increased liquidity in the market.

Expanding Horizons: Vietnam’s Growing Crypto Market

While the focus has largely been on Western institutions, emerging markets like Vietnam are also rapidly adopting cryptocurrencies. In 2024, Vietnam’s crypto user growth rate hit 35%, driven by younger demographics eager to explore digital asset investments. The government has begun introducing regulations, which are likely to further stimulate institutional interest.

Investors in Vietnam are also keen to learn about tiêu chuẩn an ninh blockchain to ensure the safety and governance of their investments. Tools such as analytics and monitoring systems are becoming crucial.

Conclusion: The Road Ahead for MicroStrategy and Institutional Clients

As institutional clients continue to engage with Bitcoin, MicroStrategy stands at the forefront, creating a bridge between traditional finance and digital currencies. Their efforts have not only set benchmarks for security and policy-making but have also encouraged widespread adoption of Bitcoin.

By understanding the benefits and challenges, potential investors can better navigate the ever-evolving cryptocurrency landscape. If you’re considering entering this space, consulting with experienced advisors and staying abreast of market trends is crucial.

As we look to the future, it’s clear that MicroStrategy’s innovative approach will continue to influence how institutional investors connect with Bitcoin. By leveraging their expertise, more institutions can join this digital asset revolution.

If you’d like to learn more about best practices for institutional investment in Bitcoin, visit bitcoincashblender.

About the Author: Dr. Alice Ngo, a financial analyst specializing in cryptocurrency investments, has published over 30 papers on blockchain technology and has led audits for several well-known crypto projects.