Introduction

With Bitcoin price fluctuations impacting investments globally, major corporations like MicroStrategy have adopted strategies focusing on Bitcoin integration. As of late 2024, the crypto market is experiencing significant volatility, raising questions about its long-term implications for businesses. MicroStrategy’s approach to analyzing Bitcoin price volatility offers valuable insights for investors and stakeholders alike.

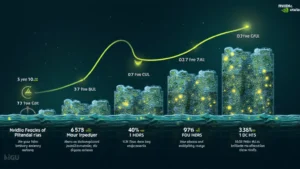

MicroStrategy’s Investment in Bitcoin

MicroStrategy, under the leadership of CEO Michael Saylor, has made headlines for its massive investment in Bitcoin. The company holds over 100,000 BTC and has utilized Bitcoin as a primary treasury reserve asset. This strategy reflects a significant shift from traditional fiat currencies. Let’s delve into how this has shaped their business model:

- Long-Term Holdings: MicroStrategy views Bitcoin as a store of value, similar to digital gold.

- Integration into Business Strategy: Offering educational services and insights around Bitcoin integration for enterprises.

- Leveraging Market Trends: Analyzing market volatility helps the company strategize its investments and hedging approaches.

Analyzing Bitcoin Price Volatility

Bitcoin’s price is notoriously volatile, which presents both opportunities and risks. Understanding the factors that contribute to this volatility can help businesses mitigate risks and capitalize on potential gains. Some key aspects include:

- Market Sentiment: News, regulatory changes, and technological developments can greatly influence market perception.

- Supply and Demand: The limited supply of Bitcoin, coupled with increasing demand, creates price dynamics.

- Macro-Economic Factors: Inflation rates, interest rates, and economic policies can also play critical roles.

Impact of Bitcoin Volatility on MicroStrategy

MicroStrategy’s business model heavily relies on Bitcoin price volatility. As the company accumulates Bitcoin, the fluctuations directly affect its balance sheet. Here’s how:

- Asset Valuation: Daily price changes can lead to significant fluctuations in asset valuation.

- Market Position: A strong performance can enhance investor confidence, but downturns might prompt skepticism.

- Strategic Adjustments: Understanding price movements enables MicroStrategy to adapt its investment strategies promptly.

Bitcoin Volatility: Global Trends vs. Vietnam

In recent years, Vietnam has seen a surge in crypto adoption. According to local reports, there has been a 37% increase in cryptocurrency users in Vietnam, highlighting a growing interest in Bitcoin. This trend presents unique opportunities and challenges for Vietnamese investors and businesses:

- Local Adoption Rates: With increasing local engagement, there’s room for innovative services supporting Bitcoin transactions.

- Regulatory Environment: The evolving legal framework can create challenges but also opportunities for compliant businesses.

- Consumer Education: As people become more curious about cryptocurrency, there’s a need for educational resources.

Strategies to Mitigate Volatility Risks

For companies like MicroStrategy, mitigating the risks associated with Bitcoin price volatility is crucial. Here are several strategies that organizations can consider:

- Diversify Investments: Maintaining a diverse portfolio can help cushion against Bitcoin’s wild price swings.

- Hedging Techniques: Utilizing futures contracts or options may provide protection against downward trends.

- Regular Market Analysis: Keeping abreast of market trends can inform timely decision-making.

Conclusion

MicroStrategy’s Bitcoin price volatility analysis provides an eye-opening perspective on how businesses can learn to adapt to the nuances of the cryptocurrency market. In an ever-evolving landscape, understanding these fluctuations is not merely a luxury; it’s a necessity for survival and growth.

For anyone looking to dive into related topics, check out our article on 2025’s most promising altcoins and explore the fascinating world of cryptocurrency investments. Not financial advice. Consult local regulators concerning cryptocurrency-related activities.