Navigating Bitcoin ETF Regulatory Compliance: A 2025 Guide

In recent years, the acceleration of Bitcoin ETFs (Exchange-Traded Funds) has brought about significant transformations within the financial landscape. With the total cryptocurrency market capitalization reaching an impressive $3 trillion within the first quarter of 2024, the demand for regulatory clarity on investment vehicles like Bitcoin ETFs has never been more pressing. A question that prevails among investors is: how does one navigate Bitcoin ETF regulatory compliance? This guide will delve into the intricacies surrounding this topic while providing practical insights tailored to the Vietnamese market, where interest in digital assets continues to surge.

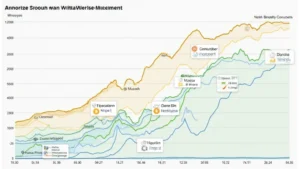

The Growing Interest in Bitcoin ETFs

As we approach 2025, traditional investors are casting their nets into the burgeoning waters of cryptocurrency, with Bitcoin ETFs at the forefront. Each Bitcoin ETF aims to provide an easy entry point for traditional investors looking to gain exposure to Bitcoin without the complexity of managing digital wallets and private keys. Let’s break down why regulatory compliance is vital for the legitimacy and success of these financial products.

The Role of Regulatory Bodies

- Regulatory bodies such as the SEC (Securities and Exchange Commission) in the U.S. play a pivotal role in overseeing Bitcoin ETF applications.

- These organizations ensure that financial products meet specific regulatory standards to protect investors from fraud and market manipulation.

- Non-compliance can lead to severe consequences, including denied applications and potential legal ramifications.

Understanding Bitcoin ETF Structures

To grasp the compliance issues surrounding Bitcoin ETFs, we first need to understand their structures. Bitcoin ETFs can be broadly categorized into two types:

- Physical ETFs: Funds that hold actual Bitcoins, aiming to track the asset’s price directly.

- Futures-based ETFs: Funds that invest in Bitcoin futures contracts rather than holding the underlying digital currency.

Each structure comes with its unique regulatory nuances. For instance, physical ETFs often face stricter scrutiny concerning custodianship and storage solutions. Regulations such as the tiêu chuẩn an ninh blockchain (blockchain security standards) will be vital in ensuring safe and compliant storage of the underlying assets.

Challenges in Regulatory Compliance

Regulatory compliance is a complex challenge that promotes a dialogue centered on investor protection, market integrity, and the rapid evolution of technology. Below are common challenges faced by Bitcoin ETF issuers in obtaining compliance:

- Vague Regulations: Many markets worldwide lack clear-cut regulations tailored to the cryptocurrency landscape, causing uncertainty for potential ETF sponsors.

- Market Manipulation Concerns: Regulatory bodies are hesitant to approve ETFs amid fears of market manipulation within Bitcoin’s unregulated environment.

- International Differences: Different countries have varying standards, which complicate multinational operations for companies seeking to create Bitcoin ETFs.

A Closer Look at the Vietnamese Market

Vietnam is emerging as a hotspot for cryptocurrency investments, with a staggering growth rate of 150% in the number of cryptocurrency investors observed in 2024. This burgeoning interest sets the stage for discussing Bitcoin ETFs and the regulatory frameworks crucial for their success.

However, Vietnam’s regulatory environment for cryptocurrencies is still evolving. As of now, Vietnamese authorities have yet to fully regulate digital assets, which presents both challenges and opportunities for potential Bitcoin ETF issuers. Here’s how this could unfold:

- Increasing Interest: The rising number of Vietnamese investors could lead regulators to consider developing a framework tailored for cryptocurrency funds.

- Cross-border Implications: Vietnamese investors seeking exposure to Bitcoin ETFs offered in jurisdictions with clearer regulations may push for localized compliance standards.

Practical Steps for Compliance

For any entity looking to create a compliant Bitcoin ETF, adhering to a structured approach is necessary. Here are practical steps to consider:

- Engage Legal Experts: Consult with legal firms that specialize in cryptocurrency to ensure an understanding of applicable laws and regulations.

- Establish Custodianship: Secure and regulated custodians for holding the assets is crucial. This process should comply with existing regulations for asset management.

- Adopt Transparent Reporting: Regular audits and reports will foster trust with regulators and investors alike.

Case Studies and Successful Examples

Several Bitcoin ETFs have successfully navigated the complex regulatory landscape, offering insightful examples for potential issuers:

- Grayscale Bitcoin Trust (GBTC): This is a well-known fund that operates under existing securities regulations, paving the way for future Bitcoin investment vehicles.

- ProShares Bitcoin Strategy ETF: This ETF utilizes Bitcoin futures and gained approval due to its transparent structure and compliance with regulatory guidelines.

Each case reflects strategies that can be applicable for upcoming initiatives, especially in markets like Vietnam where structured guidance can lead to successful launches.

The Future of Bitcoin ETFs and Compliance

As we project into the future, the demand for Bitcoin ETFs will only solidify. The momentum for greater regulatory clarity is expected to continue, especially as more institutional and retail investors gravitate towards cryptocurrency investment. By adhering to necessary compliance measures and fostering collaboration with regulators, companies can ensure that Bitcoin ETFs cater to a wide range of investors while maintaining market integrity.

In conclusion, understanding Bitcoin ETF regulatory compliance is essential for success in the digital asset space. Adapting to regulations and building a trusted environment can lead to the growth of Bitcoin ETFs, not just in Vietnam, but globally. Companies are encouraged to focus on their legal obligations and investor protections to create compliant and successful investment products.

With the impending developments in the cryptocurrency market, there’s no better time than now for informed investors to remain ahead of the curve in navigating Bitcoin ETFs and their associated regulatory environments.

Remember, this guide serves as an informative piece and should not be treated as financial advice. Always consult local regulations and legal experts for tailored guidance.

To learn more about effective compliance measures for cryptocurrencies, visit hibt.com.

For anyone looking to explore secure methods for managing cryptocurrencies, solutions like Ledger Nano X have proven to reduce hacking risks by over 70%, making them a top choice for protecting digital assets.

As the cryptocurrency landscape continues to evolve, staying informed and compliant will be crucial for aspiring Bitcoin ETF issuers.

Author: Dr. Nguyen Thi Minh, an esteemed blockchain researcher who has published over 20 papers in the domain and led audits for leading digital asset projects.