Introduction

As the global cryptocurrency landscape continues to evolve, one question resonates with newcomers and seasoned investors alike: How does Bitcoin mining work, and why is it crucial for the digital asset ecosystem? In 2024 alone, the cryptocurrency market saw a staggering growth of over 200%, with Bitcoin accounting for nearly half of this surge. With more than $4 billion lost to hacks, understanding the mechanism behind Bitcoin mining becomes imperative for security and investment strategy.

This article aims to dissect the nuances of Bitcoin mining, demystifying the technical jargon while providing valuable insights that align with 2025 blockchain security standards. By the end of this guide, readers will have a fundamental understanding of Bitcoin mining’s role in ensuring transaction security and network stability.

What is Bitcoin Mining?

Bitcoin mining is the process by which transactions are verified and added to the public ledger, known as the blockchain. This decentralized process involves powerful computers solving complex mathematical problems, which in turn confirms transactions and prevents double-spending. Think of mining as a bank vault for digital assets, where only verified transactions are allowed entry.

The Mechanics of Bitcoin Mining

- Proof of Work: Miners compete to solve intricate puzzles, and the first to succeed gets to add a new block to the blockchain.

- Rewards: Successful miners receive Bitcoin rewards, akin to finding treasure at the end of a maze.

- Difficulty Adjustment: The Bitcoin network adjusts the difficulty of puzzles approximately every two weeks to maintain a steady flow of new blocks.

Environmental Impact of Bitcoin Mining

As Bitcoin mining requires significant computational power, the environmental impact cannot be overlooked. Studies reveal that Bitcoin mining consumes approximately 0.5% of the world’s energy supply, leading to ongoing debates about sustainability. In Vietnam, where the user growth rate is climbing rapidly, it is essential to consider the balance between technological advancement and environmental responsibility.

How Bitcoin Mining Works

Let’s break this down step-by-step to grasp how Bitcoin mining functions:

- Transaction Pool: When people send Bitcoin, the transactions are broadcasted to the network, entering a pool waiting for confirmation.

- Block Creation: Miners compile these transactions into a block, including a unique header which carries the cryptographic hash of the block.

- Solving the Hash: Miners must solve a cryptographic puzzle linked to the previous block’s hash—this secure connection makes them tamper-proof.

- Consensus: Once a miner solves the puzzle, the new block is broadcasted to the network, and other miners verify its authenticity.

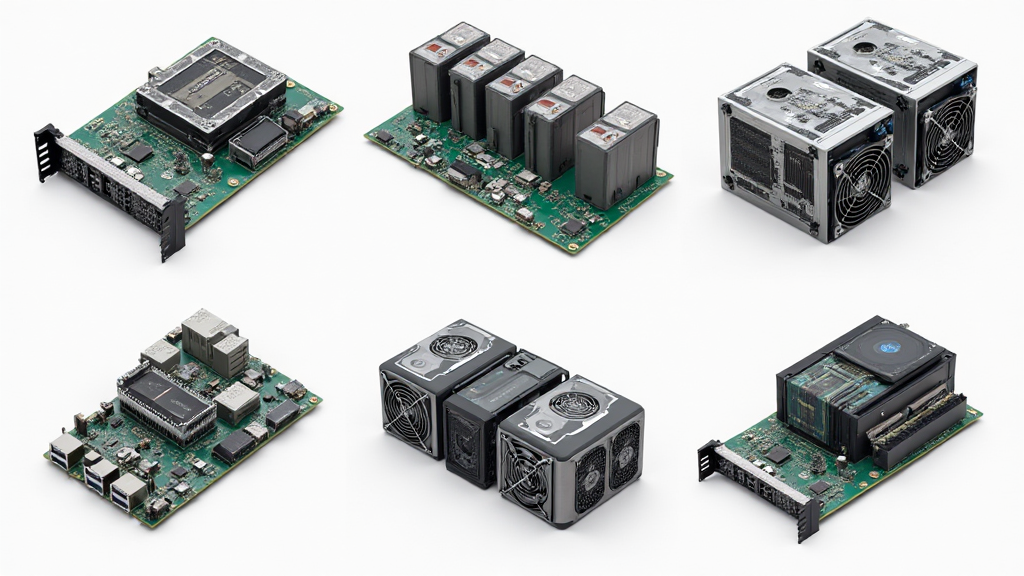

Bitcoin Mining Equipment

The choice of mining hardware plays a significant role in a miner’s efficiency. The following are common types of equipment used:

- ASIC Miners: Application-Specific Integrated Circuits are tailored for Bitcoin mining, offering high efficiency and energy output.

- GPUs: Graphics Processing Units are common among hobbyist miners; however, they are outperformed by ASICs.

- Mining Rigs: Custom-built rigs can house multiple GPUs or ASICs to maximize mining capacity.

Mining Pool Participation

As mining difficulty increases, many miners join pools to enhance their chances of earning rewards. A mining pool allows miners to collaborate, combining their computational power, which increases the likelihood of solving a block. Here’s how it benefits participants:

- Consistent Payouts: Unlike solo mining, pooled mining can provide regular rewards, even if they’re smaller.

- Sharing Resources: Members share the costs of electricity and hardware, making it more cost-effective.

The Future of Bitcoin Mining

The future of Bitcoin mining hinges on various factors, including regulatory landscapes and technological advancements. Here are some trends to watch for:

- ASIC Technology Advancements: Innovations in ASIC technology promise to enhance energy efficiency, thus reducing the carbon footprint.

- Green Mining Initiatives: With environmental concerns rising, many miners are shifting towards renewable energy sources to power their operations.

- Regulatory Developments: As countries like Vietnam continue to embrace cryptocurrency, understanding compliance for mining operations is vital for sustainable growth.

Bitcoin Mining and Regulatory Compliance

As regulations surrounding cryptocurrency become more defined, miners must keep abreast of legal frameworks in their respective countries. While not financial advice, staying updated with local regulations ensures a smoother operational setup. Consider this: if you are in Vietnam, ensure that your mining practices align with relevant blockchain regulations (tiêu chuẩn an ninh blockchain).

Conclusion

Bitcoin mining remains a pivotal component of the cryptocurrency market. As understanding deepens among participants, the security and efficiency of these operations can lead to more robust networks, ultimately enhancing user trust in Bitcoin and other digital assets. With tools like Ledger Nano X reducing hacks by 70%, miners and investors alike can bolster their security strategies.

In a rapidly changing environment, the nuances of Bitcoin mining cannot be underestimated. With ongoing progress in technology and deeper insights into environmental impacts, the future of Bitcoin mining holds great promise—not only for individual miners but also for the entire crypto ecosystem.

To explore more about Bitcoin and crypto security, visit bitcoincashblender.