Introduction: The Rise of HIBT Derivatives Trading Platforms

In the ever-evolving world of cryptocurrency, the launch of HIBT derivatives trading platforms marks a significant shift in how traders approach the market. With over $4.1 billion lost to DeFi hacks in 2024, securing digital assets has never been more crucial. HIBT platforms promise to provide an innovative solution for investors seeking to leverage their trades while reducing risk.

Understanding HIBT: What Makes These Platforms Stand Out?

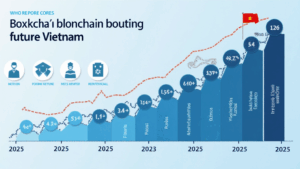

HIBT (Hybrid-Integrated Blockchain Trading) is a groundbreaking approach in the derivatives trading landscape. By blending blockchain technology with innovative trading strategies, users can enjoy enhanced security and transparency. The popularity of such platforms has surged, especially in markets like Vietnam, where user growth rate reached 150% last year, driven by increasing adoption among millennials and tech-savvy individuals.

1. Key Features of HIBT Derivatives Platforms

- Enhanced Security: The incorporation of blockchain technology minimizes the risk of hacks.

- Transparency: Real-time auditable transactions enhance trust among users.

- Leverage Options: Traders can amplify their positions, leading to higher potential returns.

- User-Friendly Interface: Designed for both novice and experienced traders.

2. The Role of Smart Contracts in HIBT Platforms

Smart contracts are self-executing contracts with the terms directly written into code. They play an essential role in ensuring automated, trustless transactions on HIBT platforms. But, how can users audit smart contracts before engaging in trades? Let’s break it down:

- Understand the Contract Logic: Review the code structure and flow.

- Check for Bugs: Look for common vulnerabilities that could lead to exploits.

- Use Audit Tools: Utilize available tools to ensure thorough checking.

- Seek Expert Reviews: Professional audits can significantly bolster trust.

3. Market Trends Influencing HIBT Derivatives Trading

The cryptocurrency market is influenced by several factors. For example, in Vietnam, regulatory frameworks are evolving. As governments embrace cryptocurrency, trading platforms are becoming more compliant. According to Chainalysis, the transaction volume in Vietnam surged up to 110% in just 12 months. Investors are seeking reliable platforms that combine regulatory compliance with innovative trading strategies.

4. Navigating Risks and Challenges

While HIBT platforms offer countless benefits, it’s important to recognize potential risks:

- Market Volatility: Cryptocurrency prices can fluctuate rapidly, leading to potential losses.

- Regulatory Changes: Sudden regulations can affect how platforms operate.

- Security Vulnerabilities: Despite enhanced measures, no platform is entirely foolproof.

5. The Future of HIBT Derivatives Trading

As we look ahead to 2025, the landscape for HIBT derivatives trading platforms appears promising. Innovations in technology and security will continue to pave the way for safer trading environments. Partnerships between traditional financial firms and crypto platforms will likely emerge, bridging the gap between conventional investing and cryptocurrency trading.

Conclusion: Unlocking Opportunities with HIBT Derivatives Trading

Consumer interest in HIBT derivatives trading platforms is expected to continue growing, particularly as new technologies enhance security and usability. As cybersecurity remains a concern—especially given the staggering amounts lost to hacks—traders must select platforms that prioritize these standards. Choosing a reliable platform like HIBT can significantly enhance your trading experience as we move into the future, especially in rapidly growing markets like Vietnam.

Not financial advice. Consult local regulators.