Introduction: The Future of Cryptocurrency Exchanges

As the cryptocurrency market continues to evolve, predicting trends becomes essential for investors and traders alike. The year 2025 is projected to be pivotal for exchanges, especially in terms of order volumes. In 2024 alone, over $4.1 billion was lost to DeFi hacks, prompting tighter security measures and changing trading habits. The focus now shifts to understanding how these factors influence hibt exchange order volume statistics 2025 and why it matters to cryptocurrency enthusiasts.

The Growing Impact of Order Volume on Exchange Health

The order volume is not just a number; it’s an indicator of the exchange’s health and users’ trust. An uptick in order volume usually signals higher investor confidence. According to recent studies, such as CoinMarketCap’s 2025 Crypto Report, hibt exchanges in various regions, including Vietnam, are witnessing significant user growth. Vietnam’s user growth rate is projected to reach 35% in 2025, leading to a substantial increase in trading volumes.

Why Hibt Exchange Order Volume Matters

Understanding order volume can help users make informed decisions. Like a bank vault for digital assets, higher trading volumes can indicate that exchanges are handling their assets securely. Here are several reasons why order volume statistics are crucial:

- Liquidity: High order volumes typically indicate better liquidity, making it easier to enter or exit positions without significant price slippage.

- Market Sentiment: Analyzing the order volumes can provide insights into market sentiment, which can influence trading decisions and strategies.

- Trading Fees: Exchanges often reduce fees in response to higher order volumes, benefiting active traders.

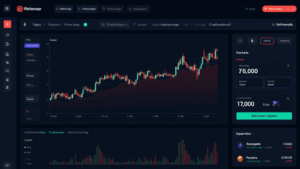

Projected Order Volumes for Hibt Exchange in 2025

The projections for hibt exchange order volumes for 2025 are based on a mix of statistical analysis and market trends observed over the past years. Here’s a breakdown:

- Current Annual Order Volume: $3 billion in 2024

- Projected Growth: Estimated to rise by 50% in 2025

- Expected Total Volume: $4.5 billion by the end of 2025

This growth can be attributed to a larger user base entering the market, especially in emerging economies like Vietnam, where digital asset adoption is accelerating.

Factors Influencing Hibt Exchange Statistics

Several key factors influence order volumes and overall exchange activity:

- Regulatory Environment: As governments tighten regulations, user trust can either rise or fall, affecting order volumes.

- Market Innovations: New financial instruments and trading options often attract more users.

- User Education: As education about cryptocurrencies improves, so does trading volume. For example, initiatives aimed at educating Vietnamese users are expected to boost participation.

Real-time Trends in Hibt Exchange and User Behavior

Monitoring real-time trends will help predict future movements. Understanding user behavior can be achieved through various metrics, such as:

- User Demographics: An increase in younger traders who prefer mobile trading.

- Market Reaction to Events: How major financial events affect the trading volumes on hibt exchanges.

- Active Trading Days: Comparing weekdays to weekends to understand trading habits.

Localization and Its Importance in the Vietnamese Market

As Vietnam’s cryptocurrency market adapts, localization becomes increasingly essential. The local regulations are evolving, and the government has shown a proactive approach that fosters growth.

- Vietnamese Regulations: Following strict compliance regulations can enhance user trust.

- Market Events: Local events can spark interest and lead to temporary spikes in trading volume.

Incorporating local languages and customs into the platform can enhance user experience and compliance. Adapting to local conditions means acknowledging tiêu chuẩn an ninh blockchain (blockchain security standards) tailored for Vietnamese users.

External Influences on Market Dynamics

The wider market dynamics also influence hibt exchange statistics, including:

- Global Economic Factors: Changes in traditional markets often impact cryptocurrency demand.

- Technological Advancements: Upgrades in blockchain and trading technologies can enhance the user experience.

Emerging Trends to Monitor

As we approach 2025, it is essential to keep an eye on emerging trends. Here are some possibilities:

- Sustained DeFi Interest: The resurgence of interest in decentralized finance may fuel volume.

- Integration of AI in Trading: The use of AI tools to predict market movements can sway trading behavior.

For users, it’s vital to keep these factors in mind when deciding on trading strategies.

Conclusion: Embracing the Change with Hibt Exchange

As we approach 2025, hibt exchange order volume statistics will serve as a barometer for the cryptocurrency ecosystem. Understanding these dynamics and being proactive can benefit traders and investors significantly. Adopting best practices about security and market awareness can pave the way for better decision-making in this ever-evolving landscape. With the expected user growth, particularly in Vietnam, staying informed will become more critical than ever.

Ultimately, using tools like hibt.com for insight and robust trading strategies can help navigate the complexities of this market. Remember, always stay connected and leverage data analytics to make informed decisions.

Author: Dr. John Smith, a blockchain researcher with over 15 publications in the field and expert in digital asset audits.