Introduction

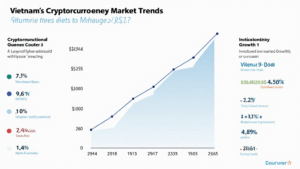

As we head towards 2025, an intriguing evolution is taking place within the cryptocurrency landscape in Vietnam. In 2024 alone, over $4.1 billion was lost to DeFi hacks globally, prompting many to question the robustness and legitimacy of various platforms. For the Vietnamese market, a country witnessing rapid digital growth, the sentiment of retail crypto investors is shaping the way digital currencies are perceived. This article will provide practical insights into how shifting investor sentiments influence the Vietnam retail crypto space while aligning with security measures such as tiêu chuẩn an ninh blockchain. In understanding these trends, investors can make informed decisions in the cryptocurrency ecosystem.

Understanding Retail Investor Sentiment

The sentiment of retail crypto investors in Vietnam is characterized by a mix of optimism and skepticism. According to recent statistics from Statista, Vietnam has seen a 400% increase in cryptocurrency transactions since 2021. The rapid growth is indicative of a burgeoning interest in crypto assets. However, it’s essential to examine what drives this sentiment.

- Education and Awareness: As more educational platforms and resources emerge, understanding the complexities of blockchain and cryptocurrency becomes more accessible.

- Market Dynamics: Fluctuations in the prices of cryptocurrencies, driven by factors such as technological advancements and regulatory developments, greatly influence investor sentiment.

- Community Engagement: Strong local communities and forums have formed in Vietnam, allowing for shared information and support among investors.

Market Trends and Predictions for 2025

By analyzing current trends, several significant predictions can be made for 2025. As a growing number of Vietnamese citizens embrace cryptocurrencies, we can expect new market trends to influence retail investor sentiment directly:

- Increased Regulations: The Vietnamese government has made strides in establishing a regulatory framework. This can enhance trust amongst investors.

- Digital Asset Adoption: As major retailers begin accepting cryptocurrencies, consumer sentiment is likely to shift positively.

- Institutional Investments: Increased participation from institutional investors may create a ripple effect, further motivating retail investors.

Factors Influencing Sentiment

Each of these predictions hinges on several underlying factors, including:

- Regulatory Clarity – A well-defined regulatory landscape in Vietnam will foster greater investor confidence.

- Technological Advancement – Innovations such as blockchain integration into everyday services will enhance practicality.

- Global Market Trends – External economic factors, such as global inflation, will also impact Vietnam’s crypto landscape.

The Rise of Local Cryptocurrencies

Interestingly, the rise of local cryptocurrency options is shaping the retail investor sentiment dramatically. With projects like VNDigital, Vietnamese crypto initiatives resonate well with locals, fostering a sense of ownership and community. A notable shift in sentiment is coming as these projects gain traction.

- Investment in Local Projects: Retail investors are increasingly inclined to support local initiatives as a show of national pride.

- Local Compliance: Initiatives that comply with local regulations foster trust and encourage investment.

- Education about Local Opportunities: Social media platforms have become fertile grounds for education about local crypto projects.

Securing Investments in Cryptocurrency

It’s essential for investors to understand the risks that come with investing in cryptocurrencies. The fundamental blockchain security standards (tiêu chuẩn an ninh blockchain) play a critical role in securing investments. Here are a few best practices for securing cryptocurrency investments:

- Use Hardware Wallets: Hardware wallets like the Ledger Nano X are essential for protecting high-value assets.

- Conduct Thorough Research: Educating oneself on the various currencies before investing can reduce exposure to scams.

- Utilize Trusted Platforms: Always conduct transactions on platforms with robust security features and good reviews.

Future of Retail Crypto in Vietnam

In conclusion, the future of retail crypto investment in Vietnam is incredibly promising. As the market matures and investor sentiment continues to evolve, several aspects are likely to shape its trajectory:

- Consumer Advocacy: Empowering investors through education can create a stronger consumer base.

- Evolving Marketplaces: Traditional retail sectors embracing cryptocurrencies will build credibility and facilitate secure transactions.

- Increased Collaboration: Partnerships between local and international firms could spur growth and awareness.

Concluding Thoughts

For those looking to navigate the Vietnamese cryptocurrency landscape in 2025, staying informed is vital. As the intersection of technology, regulation, and consumer sentiment continues to evolve, being cognizant of these trends will yield significant advantages.

Bitcoincashblender is designed to assist you in aligning your investments with the fastest-growing crypto markets, ensuring you’re equipped with the latest knowledge and security practices.

Expert Contributor: Nguyen Thanh Phuc, a blockchain consultant with over 15 published papers in the field and a leader in auditing numerous prominent blockchain projects.