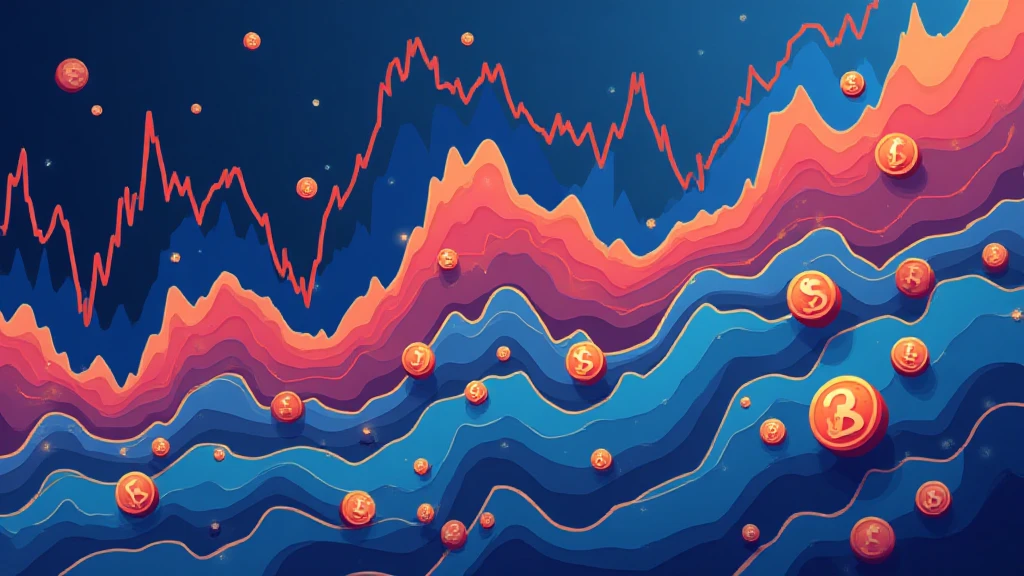

HIBT Crypto Market Volatility: Navigating the Future of Digital Currency

As the world becomes increasingly reliant on digital currencies, understanding market volatility is crucial. With estimates indicating that around $4.1 billion was lost to DeFi hacks in 2024 alone, it’s evident that navigating the HIBT crypto market volatility requires expertise and caution.

Blockchain technology is at the forefront of these market shifts, making compliance and security essential. With an increasing number of users adopting cryptocurrency, particularly in regions like Vietnam, the need to grasp the nuances of this economic frontier becomes even more pressing.

Understanding Crypto Market Volatility

Market volatility refers to the rate at which the price of a cryptocurrency increases or decreases for a given set of returns. Markets can be influenced by numerous factors, including news events, investor sentiment, regulatory changes, and technological advancements.

- Investor Behavior: Speculative trading often leads to rapid price swings.

- Market Sentiment: News can dramatically sway public perception and, consequently, prices.

- Regulatory Changes: New laws and regulations can cause immediate effects on market volatility.

The Role of DeFi in Market Volatility

Decentralized finance (DeFi) has introduced new pathways for investment and trading but also comes with its own set of risks. Platforms that facilitate these transactions often lack robust security and regulatory frameworks. Here’s how DeFi contributes to market fluctuations:

- Lack of Regulation: The absence of oversight can lead to market manipulation.

- Smart Contract Vulnerabilities: Bugs and loopholes in smart contracts can lead to significant losses.

- Market Saturation: With an influx of new tokens, distinguishing between the valuable and the frivolous becomes challenging.

Essential Strategies to Manage HIBT Crypto Market Volatility

Whether you’re a seasoned investor or a newcomer in the crypto space, it’s vital to have effective strategies to manage potential risks. Here’s a breakdown of approaches:

Diversification Across Digital Assets

Diversifying your investment portfolio across different cryptocurrencies can help mitigate risks. Instead of betting all on a single digital asset, consider:

- Investing in established cryptocurrencies like Bitcoin and Ethereum.

- Including emerging coins with significant potential.

- Considering stablecoins to limit risk exposure.

Staying Informed: Monitoring News and Trends

Staying updated with the latest developments in the cryptocurrency market is key to anticipating changes in volatility. Get involved in communities, forums, and news outlets that focus on crypto innovation.

For instance, monitoring hibt.com for insights on market trends can provide valuable data and investment advice.

The Impact of Social Media on Crypto Volatility

Social media platforms can amplify market trends in real-time, creating spikes or drops based on public sentiment. In 2023, a survey indicated that over 60% of investors relied on social media for crypto news.

- Influencer Effect: Well-known figures can sway their followers towards or away from particular investments.

- Trend Propagation: Viral news stories can create short-lived market movements.

Prudent Trading Practices

Implementing prudent trading practices can directly influence how you deal with market volatility:

- Utilizing stop-loss orders to limit losses.

- Setting take-profit points to secure gains during bull runs.

- Regularly analyzing market data to adjust strategies accordingly.

Conclusion: Embracing HIBT Crypto Market Volatility

As we move forward, embracing the challenges presented by HIBT crypto market volatility while applying informed strategies will be key to sustainable growth and success in the cryptocurrency landscape.

For both new and experienced traders, leveraging data, insights, and community resources will pave the way toward understanding and mitigating risks associated with market fluctuations. As we explore the dynamic nature of this domain, knowledge will remain our greatest ally.

For more valuable insights on navigating the financial winds of crypto volatility, consider visiting bitcoincashblender.