Bitcoin Price Historical Trends: Understanding the Market

As we delve into the realm of cryptocurrency, the price history of Bitcoin cannot be overlooked. There have been numerous fluctuations, highs, and lows that not only shape investors’ decisions but also depict the evolving nature of the crypto industry. With an estimated $4.1 billion lost to DeFi hacks in 2024 alone, understanding these historical trends becomes paramount for individuals aiming to navigate the volatile landscape of digital assets.

The Rise of Bitcoin: An Overview

Bitcoin was created in 2009 by an anonymous person or group known as Satoshi Nakamoto. The initial trading price was merely a fraction of a cent. Fast forward to today, and Bitcoin has witnessed astonishing growth, peaking at nearly $65,000 in April 2021. This growth begs the question: what factors have driven Bitcoin’s price up and down over the years?

Key Factors Influencing Bitcoin Prices

- Market Demand: One of the primary factors for the rise in Bitcoin’s price is market demand. When more individuals and institutions show interest in owning Bitcoin, the price rises. Conversely, lower interest or negative news can lead to a decline in price.

- Regulatory Developments: Bitcoin’s price has also been significantly affected by legislative changes and regulations worldwide. For instance, news about tighter regulations in major markets like the U.S. or China can lead to price drops.

- Technological Advances: Innovations in blockchain technology can affect Bitcoin prices. For instance, improvements in the security and efficiency of Bitcoin transactions can increase investor confidence.

- Media Influence: The impact of media coverage on Bitcoin prices cannot be ignored. Positive or negative articles can sway public perception and affect buying behavior.

- Macroeconomic Factors: Broader economic signals like inflation rates or stock market trends play significant roles. For example, with increasing inflation rates, investors often flock to Bitcoin as a hedge.

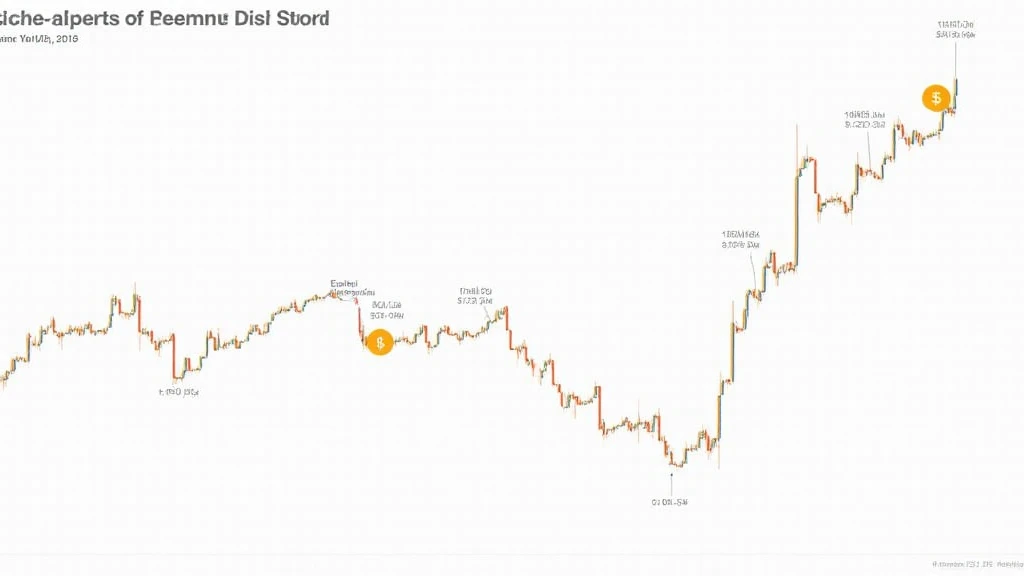

Bitcoin’s Price Peaks and Valleys: A Timeline

To further comprehend Bitcoin’s historical pricing trends, let’s break down some significant events that have shaped its price trajectory:

- 2013: Bitcoin hit $1,000 for the first time, showcasing its increasing acceptance.

- 2017: The price soared to nearly $20,000, fueled by mass media attention and the ICO boom.

- 2018: The market corrected, and Bitcoin’s price fell below $4,000 by December.

- 2020: The onset of the COVID-19 pandemic led to Bitcoin’s resurgence, with prices climbing back to $29,000 by year’s end.

- 2021: Bitcoin reached an all-time high of $65,000 before experiencing significant corrections.

Understanding Price Corrections

Price corrections in Bitcoin can often lead to nervousness among investors. Sometimes they are as significant as a 30-40% drop from recent highs. But here’s the catch: these corrections are often seen as opportunities rather than pitfalls. Just like a bank vault for digital assets, if you understand market behavior, you can utilize corrections to your advantage.

In Vietnam, the growing user base for cryptocurrency has played a crucial role in market dynamics. According to reports, the number of Vietnamese crypto users increased by 30% over the past year, showing an uptick in interest for Bitcoin amidst increasing global acceptance.

Common Misconceptions About Bitcoin Price Trends

There are many myths surrounding Bitcoin’s price which can mislead potential investors:

- Bitcoin is only a speculative asset: While many view Bitcoin in a speculative light, it has proven itself as a store of value, much like gold.

- Price always follows media hype: Although media influence is evident, Bitcoin has its cycles based on technological adoption and market maturity.

- Bitcoin’s price cannot recover after a downturn: Bitcoin has historically shown resilience after price corrections, often regaining lost ground with time.

The Future of Bitcoin Pricing

As we approach 2025, understanding Bitcoin pricing trends will be essential for those looking to invest. Analysts predict that potential adoption in areas like digital payments, remittances, and store-of-value functions may propel Bitcoin prices further.

Utilizing tools like hibt.com can help investors remain informed about ongoing price changes and market trends. Here are some potential trends that could shape the market:

- Increased Institutional Participation: As more institutions invest, expect substantial price stability and growth.

- Global Regulation: More regulation can either bolster confidence or dampen enthusiasm based on how it is structured.

- Technological Improvements: Advancements in blockchain might make transactions easier and Bitcoin more accessible.

Final Thoughts

Investing in Bitcoin requires a thorough understanding of its historical price trends. By recognizing how market dynamics influenced its price in the past, investors can make more informed decisions moving forward. As a reminder, this article is not financial advice; always consult your local regulators.

In conclusion, if you’re looking to engage with Bitcoin, remember to stay educated, remain aware of regulatory shifts, and keep an eye on technological advancements. With the right knowledge, you might find yourself navigating the world of Bitcoin more confidently.

For additional resources, consider checking our articles on cryptocurrency trends. For instance, Read our Vietnam crypto tax guide for insights into the crypto investment landscape.

Author: John Smith, a cryptocurrency market analyst with over 15 years of experience in blockchain technology, having published 30 papers, and led significant audit projects in the blockchain space.