Unlocking the Future: HIBT Crypto Derivatives Trading Bots

With the rise of digital currencies, the demand for efficient trading solutions has soared. In fact, the global crypto trading market is projected to reach $7.5 billion by 2025. As digital assets continue to grow in popularity, traders seek advanced tools like HIBT crypto derivatives trading bots to enhance their trading strategies.

The Bot Revolution: Transforming Crypto Trading

Let’s break it down. Just like a traditional stock market, cryptocurrencies have many types of assets and trading methods. However, the crypto market is more volatile and fast-paced. This is where trading bots come into play. These automated systems analyze market data and execute trades based on pre-defined criteria, offering users a significant edge.

The advent of cryptocurrencies in Vietnam has witnessed a staggering 75% growth rate among users in the past two years. This growth fuels the necessity for trading bots that can handle the fast-moving landscape of crypto derivatives, allowing traders to maximize profits while minimizing risks.

Understanding HIBT Trading Bots

HIBT trading bots specialize in derivatives trading, providing a range of features that set them apart from traditional bots. Here’s a closer look at what makes them appealing:

- Automated Trading: Bots execute trades automatically based on strategies coded into their software, minimizing human error and maximizing efficiency.

- Real-Time Analysis: Equipped to analyze vast amounts of data quickly, HIBT bots can spot trends and execute trades faster than any human can.

- Risk Management: These bots often come with built-in risk management protocols to help users navigate the often unpredictable crypto market.

The Power of Automation: Advantages of Using HIBT Bots

There are numerous benefits to incorporating HIBT crypto derivatives trading bots into your trading strategy:

- 24/7 Trading: Unlike humans, bots do not need to sleep, allowing them to trade around the clock.

- Emotion-Free Decisions: Bots operate based on logic and algorithms, eliminating emotional trading decisions that can lead to losses.

- Customizable Strategies: HIBT bots can be tailored to fit specific trading preferences and risk profiles.

Potential Pitfalls: What to Watch For

Like any technology, trading bots have their drawbacks. It’s essential for traders to remain vigilant:

- Market Dependencies: Bots rely on accurate market data; misinformation can lead to poor trading outcomes.

- Technical Failures: Glitches and errors can occur, potentially resulting in losses.

- Over-Optimization: Some traders may over-tune their bots, making them ineffective in real market conditions.

Vietnamese Market Dynamics and HIBT Bots

Vietnam’s ongoing digital transformation presents a unique opportunity for crypto traders. Statistics indicate a significant shift towards cryptocurrency adoption in the region, with over 30% of Vietnamese internet users holding some form of cryptocurrency in 2023. It’s pivotal for traders in this context to leverage HIBT bots for derivatives trading to stay competitive and successful.

Moreover, the Vietnamese government is formulating blockchain security standards to foster a secure environment for crypto assets. The emphasis on security will undoubtedly enhance user trust, paving the way for broader acceptance of trading bots like HIBT in the Vietnamese market.

The Future of Crypto Trading with HIBT Bots

As we look ahead, the integration of artificial intelligence and machine learning in HIBT crypto derivatives trading bots will revolutionize the way trading is executed. The adaptability of these bots will allow them to learn from market fluctuations and improve their trading algorithms continuously.

Furthermore, with 2025’s blockchain security standards on the horizon, users can expect enhanced compliance and reliability from platforms like HIBT, allowing them to trade with confidence.

For traders seeking to navigate the complexities of the crypto landscape, HIBT crypto derivatives trading bots are indispensable tools. They not only provide automated solutions but also streamline the trading process, enabling users to harness the full potential of their investments.

Conclusion: Embracing Automation in Crypto Trading

In conclusion, the landscape of crypto trading is rapidly evolving, and embracing technologies like HIBT crypto derivatives trading bots could mark the difference between success and failure in your trading endeavors. Remember, while these bots can significantly enhance trading efficiency, staying informed and monitoring your investments remains key.

As the cryptocurrency market continues to mature, integrating bots will become an essential aspect of successful trading strategies, especially in regions like Vietnam where user adoption is poised for exponential growth.

Stay ahead of the curve with HIBT bots and take the leap into a more automated and profitable trading future.

Not financial advice. Consult local regulators.

For more information, visit HIBT to learn how they can help transform your trading experience.

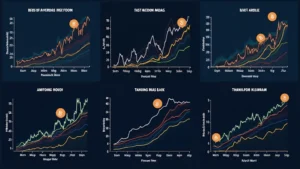

HIBT crypto derivatives trading bot features” />

Image description: A strategic overview of the HIBT crypto derivatives trading bot and its advanced features tailored for automated trading success.