Bitcoin Halving Historical Analysis: Insights and Trends

As the world continues to embrace digital assets, understanding the nuances of Bitcoin halving is vital. Did you know that halving events have been closely linked with significant price movements? In the previous halving events (2012, 2016, and 2020), Bitcoin witnessed remarkable price surges following the halving. In fact, according to market analysts, over 70% of Bitcoin’s price appreciation can be attributed to these pivotal moments. As we look towards the next anticipated halving in 2024, many enthusiasts are asking: what can we expect this time?

Understanding Bitcoin Halving

Bitcoin halving occurs approximately every four years, reducing the reward miners receive for adding new blocks to the blockchain by half. This mechanism is built into Bitcoin’s code to ensure the supply remains capped at 21 million. The upcoming halving in 2024 will reduce the block reward from 6.25 to 3.125 BTC. Understanding this concept is fundamental as it influences market supply and demand.

Historical Price Movements

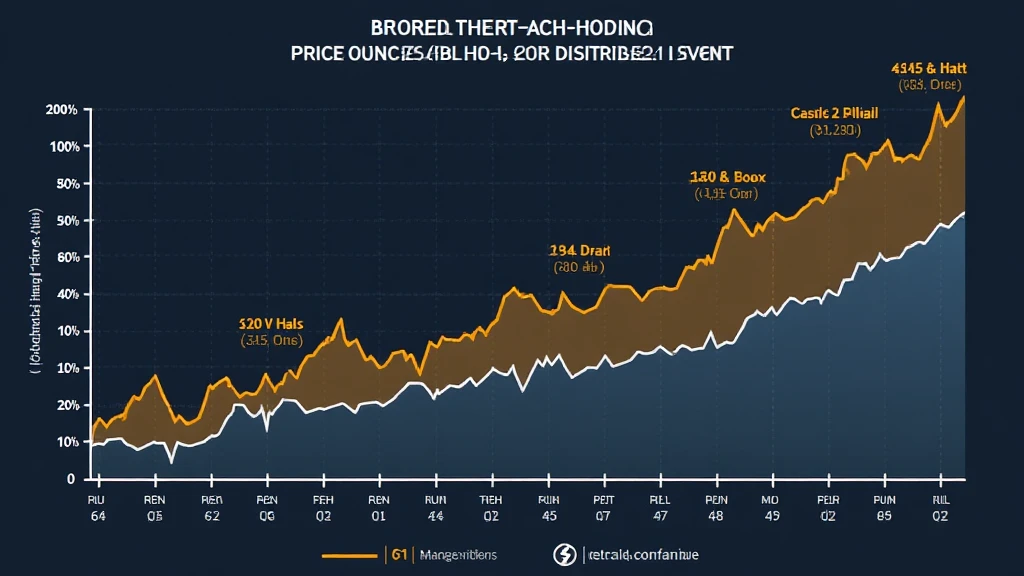

The previous halving events have shown distinct patterns:

- 2012 Halving: Bitcoin’s price increased from around $11 before the halving to approximately $1,000 within a year.

- 2016 Halving: Prices jumped from roughly $450 before the event, culminating in a surge to nearly $20,000 by late 2017.

- 2020 Halving: Bitcoin was traded around $8,800, and within a year, it peaked at over $60,000.

Each shutdown of mining rewards not only affects supply but also creates a psychological impact among investors, driving speculation and increased trading activity.

The Economic Impacts of Halving

Often compared to a stock split, halving injects volatility into the market. Here’s how:

Supply and Demand Dynamics

When rewards are halved, fewer new Bitcoins enter circulation. This scarcity effect can lead to increased demand from buyers wanting a share of the limited supply, which, as seen in previous cycles, can drive prices upwards.

Market Sentiments and Investor Behavior

Historical evidence also shows that halving events often create a bullish sentiment. As speculation rises, many investors enter the market, driven by FOMO (Fear of Missing Out). This increased activity can further push prices, creating a self-fulfilling prophecy.

The Future of Bitcoin Halving

With the next halving set for 2024, many are analyzing its potential impact, especially in markets like Vietnam, where data indicates a growing interest in cryptocurrencies. According to recent reports, Vietnamese users of cryptocurrency platforms have increased by 20% year-on-year, which suggests that local forces will amplify the effects of halving.

Long-term vs Short-term Outlooks

Investors are generally divided into two camps: short-term traders looking to capitalize on volatility and long-term holders who plan to ride out the fluctuations. Here’s a breakdown:

- Short-term Traders: Capitalize on price movements around halving.

- Long-term Holders: Accumulate bitcoins as a hedge against inflation.

Conclusion: Navigating the Next Halving

As the industry prepares for the 2024 Bitcoin halving, it’s crucial for investors to stay informed. Historical analysis indicates that these events often lead to price surges due to supply restrictions and the accompanying market enthusiasm. However, experiencing substantial price movements requires a balanced understanding of both risks and opportunities.

In summary, whether you’re a seasoned investor or a newcomer to the world of cryptocurrency, grasping the implications of Bitcoin halving can be a game changer for your investment strategy.

For more insights into crypto trends, consider visiting hibt.com. Remember, investing in cryptocurrencies carries risks, and it’s vital to do thorough research before engaging in any trades.

Also, don’t forget to explore our Vietnam crypto tax guide for comprehensive insights into taxation of digital assets. Stay informed and make educated decisions.