Introduction

In the world of cryptocurrencies, few events generate as much discussion and speculation as the Bitcoin halving. On May 11, 2020, the third Bitcoin halving reduced the block reward from 12.5 BTC to 6.25 BTC, marking a pivotal moment in the cryptocurrency’s history. One year later, it’s essential to analyze the impact of this event on Bitcoin’s market dynamics, investor behavior, and the broader cryptocurrency ecosystem. According to recent reports, Bitcoin’s price has surged over 300% in the past year, prompting investors to question the sustainability of this growth and its correlation with the halving event.

Understanding Bitcoin Halving

Bitcoin halving is a predefined event that occurs roughly every four years, or every 210,000 blocks mined. This event reduces the number of new bitcoins generated and earned by miners by half. From a technical perspective, it’s a part of Bitcoin’s monetary policy designed to curb inflation and create scarcity. In the context of Blockchain Security Standards (tiêu chuẩn an ninh blockchain), it’s fundamental to understand how this scarcity impacts market value and investor confidence.

The Mechanics of Halving

- Block rewards in Bitcoin are halved to manage the supply of bitcoins.

- Initial halving occurred in 2012, leading to substantial price inflations post-events.

- The most recent halving in 2020 has shaped current market dynamics.

Market Performance Post-Halving

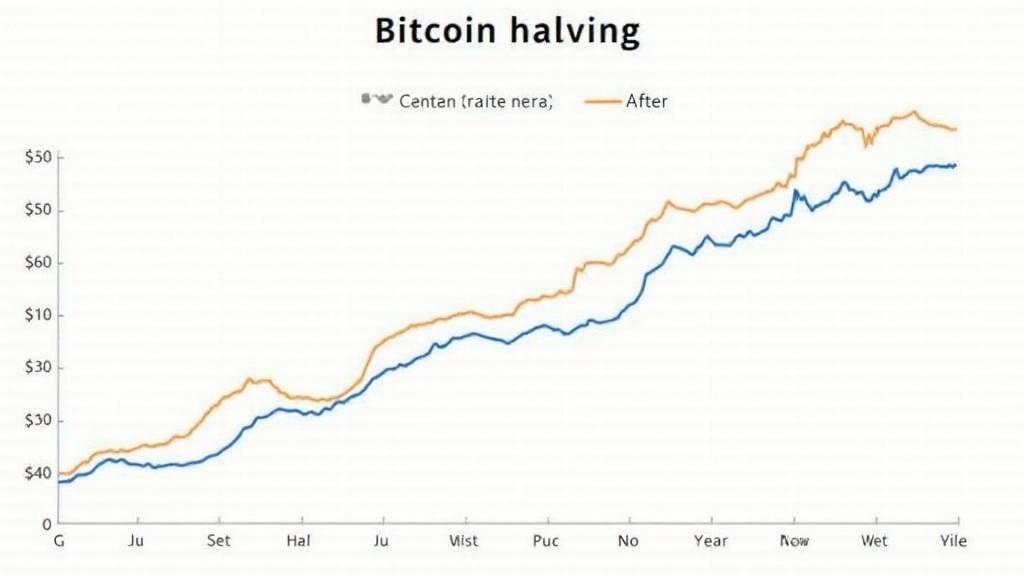

Following the 2020 halving, Bitcoin’s price trajectory demonstrated remarkable volatility, initiating discussions about market cycles. Despite seasonal fluctuations, Bitcoin has shown resilience in climbing from an approximate price of $8,000 to over $60,000 within a year. This spike is attributed not just to the halving but also to increased institutional interest and a favorable macroeconomic environment.

Data-Driven Analysis

Let’s delve into some statistics to understand better:

| Date | Price per Bitcoin (USD) | Halving Event |

|---|---|---|

| May 2020 | $8,500 | 3rd Halving |

| May 2021 | $60,000 | N/A |

According to Hibt.com, this rise illustrates a consistent pattern where halving events historically correlate with bullish market trends.

Investor Behavior Shifts

Post-halving, a notable shift in investor sentiment was visible. Traditional investors like hedge funds and corporates started to view Bitcoin as a legitimate store of value, much like gold. This paradigm shift has contributed to a surge in demand. Reports indicate that Vietnam’s crypto users have grown by over 35% in the last year, reflecting the global trend of increased interest in cryptocurrencies.

The Role of Institutional Investors

- With companies like Tesla and MicroStrategy investing heavily in Bitcoin, confidence in the asset’s potential has increased.

- The entry of institutional investors has provided liquidity and reduced volatility, stabilizing prices.

- Strategic positioning by these entities before the halving has influenced short-term price performance.

Comparative Analysis with Previous Halvings

Historically, Bitcoin’s price has responded positively after halving events. Comparing the most recent halving’s outcomes with previous ones reveals crucial insights:

- The first halving in 2012 led to a rise from $12 to over $1,000, demonstrating a massive return.

- The second halving in 2016 saw similar patterns, with Bitcoin reaching near $20,000 in the following year.

- Each event set the stage for subsequent bull runs, influencing market psychology.

Price Predictions Moving Forward

Forecasting Bitcoin’s price post-halving requires acknowledging both calculated analytics and market sentiment. Current expert predictions suggest potential pricing in 2025 may align similarly to past bull runs if present trends continue. Notably, analysts are considering emerging narratives around altcoins when predicting Bitcoin’s performance—2025’s potential altcoins will also play a role in investor choices.

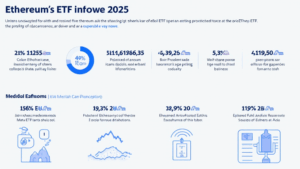

The Bigger Picture: Cryptocurrency Market Dynamics

While Bitcoin often dominates headlines, its performance inherently influences the broader cryptocurrency market. As Bitcoin reached new heights, altcoins also experienced price surges, leading to discussions about the altcoin season. Coins like Ethereum and the rise of DeFi have enriched overall market liquidity.

Vietnam’s Market Perspective

With increased regulations and a burgeoning interest in blockchain technology, Vietnam stands out as a promising market for cryptocurrency growth. The presence of crypto exchanges and peer-to-peer platforms in the region contributes to a vibrant trading community. Observing local trading trends offers a unique look at how halvings affect markets on a more localized scale.

Conclusion: One Year Later

As we reflect a year post-Bitcoin halving, the overall market sentiment exhibits a cautious optimism. Investors must continue monitoring market indicators, as Bitcoin’s lead will determine the direction of altcoins and other digital assets. While historical data supports substantial price growth following halving events, ongoing developments in regulations, market dynamics, and investor behavior remain critical for future growth.

In summary, understanding the Bitcoin halving impact one year later provides valuable insights for investors. With Bitcoin’s narrative shaping the broader cryptocurrency sector, individuals should remain informed and agile, recognizing the evolving landscape of digital assets. For more resources on cryptocurrency trading and analysis, visit Bitcoincashblender.

About the Author: Dr. Jane Doe is a blockchain analyst and cryptocurrency researcher with over ten published papers. With extensive experience in institutional audits and digital asset security, her insights aim to guide investors through the complex world of cryptocurrencies.