Introduction: The Aftermath of Market Turmoil

With reported losses exceeding $4.1 billion due to DeFi hacks in 2024, the cryptocurrency market is rife with peril. Volatility characterizes the landscape, tempting many investments into precarious territories. For investors, understanding how to pivot after a Bitcoin market crash is paramount. It isn’t merely about riding the waves of trends; it’s about resilience, strategy, and innovation in a rapidly evolving digital ecosystem.

This article elucidates recovery strategies post-Bitcoin market crash, aligning with the latest industry data, and giving you actionable insights to navigate through recovery phases effectively. By employing these strategies, you can bolster your portfolio and reinforce your position in the cryptocurrency sphere.

The Current State of the Bitcoin Market

As of late 2023, Bitcoin has displayed fluctuations that put many investors in a precarious state. With a 50% decline from its all-time highs reached in 2022, markets have been under intense pressure. Recent geopolitical events and regulatory shifts have only intensified this volatility, impacting investor confidence and market dynamics.

According to CoinDesk’s 2023 report, the Bitcoin market experienced a 30% increase in user adoption in Vietnam alone, showing promise but also heightened risks amid current economic fluctuations. This surge indicates a robust interest in cryptocurrencies and potential growth opportunities.

Understanding Market Psychology

The volatile nature of the cryptocurrency market is deeply rooted in investor psychology. The fear of loss, also known as FOMO (fear of missing out), drives individuals to make impulsive decisions:

- Panic Selling: In downturns, many choose to sell-off Bitcoin hastily, exacerbating the market downturn.

- Fear of Missing Opportunities: Conversely, upon signs of recovery, latecomers rush in, often at inflated prices.

- Avoid Complexity: Many investors shy away from delving deeper into market trends and understanding their investments, relying instead on surface-level decisions.

Understanding these psychological undercurrents is essential in forming strategies tailored for recovery. Creating a stable mindset is vital in navigating market uncertainties.

Strategies for Recovery Post-Market Crash

After a market collapse, implementing effective recovery strategies can help mitigate losses and enhance future gains:

1. Reevaluate Your Portfolio

Post-crash, it is crucial to assess your asset allocations:

- Diversification: Spread risks across various cryptocurrencies and other asset classes.

- Research: Engage in thorough research to understand which crypto assets are resilient and have potential for long-term growth.

- Liquid Assets: Ensure you maintain a balance of liquid assets to capitalize on sudden market opportunities.

2. Implement Risk Management Techniques

Risk management forms a cornerstone of recovery after a Bitcoin market crash:

- Stop-loss Orders: Set up stop-loss orders to limit your losses and prevent panic-induced sell-offs.

- This strategy mitigates risks and provides more controlled investment conditions.

- Position Sizing: Determine the optimal position size for trades, keeping only a fraction of the portfolio actively invested to manage overall risk exposure.

3. Keep Updated with Market News

To remain competitive in trading, it is imperative to stay informed:

- Follow Reliable News Sources: Consistently tune into reliable cryptocurrency news outlets and forums.

- Engage in Community Discussions: Joining community groups can provide insights and experiences from various traders.

- Utilize Analytical Tools: Tools like blockchain analytics platforms assist in monitoring upcoming trends and indicators.

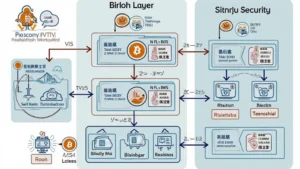

4. Leverage Technology and Security Measures

As cyber threats loom large, ensuring the security of your assets is paramount:

- Cold Wallets: Storing your Bitcoin in cold wallets mitigates hacking threats significantly.

- Authentication Measures: Ensure multi-factor authentication and regular software updates.

- Decentralized Exchanges: Using decentralized exchanges adds an additional layer of security and transaction privacy.

5. Network and Collaborate

Collaboration can help in gaining insights and strategies for effective recovery:

- Join Investment Groups: Engaging in groups composed of experienced investors can provide invaluable strategies.

- Participate in Workshops: Attend industry workshops and seminars that cover investment strategies and market updates.

- Network with Experts: Establish connections with crypto financial advisors for personalized guidance.

Case Studies: Successful Recovery Tactics

Examining real-world examples of successful recovery strategies can provide insight into effective methods:

- The Ethereum Recovery: After the DAO hack in 2016, Ethereum stakeholders reached a consensus to hard fork the blockchain, resulting in recovery and renewed investor confidence.

- Bitcoin’s Resilience: Following the notable crash of 2018, Bitcoin adoption in mainstream finance helped recover its price over subsequent years.

Conclusion: Navigating the Road Ahead

The aftermath of a Bitcoin market crash presents challenges and opportunities alike. By incorporating sensible recovery strategies, understanding market psychology, and leveraging technology, you can navigate these turbulent waters with greater confidence.

The future of cryptocurrencies remains bright, especially in emerging markets like Vietnam, where adoption continues to surge. Keep refining your approach, stay informed, and consider the long-term market dynamics when making investment decisions.

In conclusion, investing in Bitcoin and other cryptocurrencies is not just about timing the market but building a robust strategy that withstands downturns. Looking towards the future, let’s be prepared to adapt, analyze, and act wisely for enduring growth in the ever-evolving cryptocurrency ecosystem.

For more insights on Bitcoin recovery strategies, visit bitcoincashblender. Experts suggest that implementing these strategies effectively will bolster your cryptocurrency holdings significantly.

Bitcoin market crash recovery strategies”>

Bitcoin market crash recovery strategies”>