Understanding the Bitcoin Market Cycle

The Bitcoin market operates in cycles, much like the seasons of the year. Just as winter gives way to spring, a bear market can transition into a bull market after varying periods of accumulation and distribution. With an astonishing value loss of $4.1 billion due to DeFi hacks in 2024, understanding market cycles has never been more crucial for investors. In this article, we will examine Bitcoin market cycle predictions and how they can influence your investment strategy moving forward.

1. The Phases of the Bitcoin Market Cycle

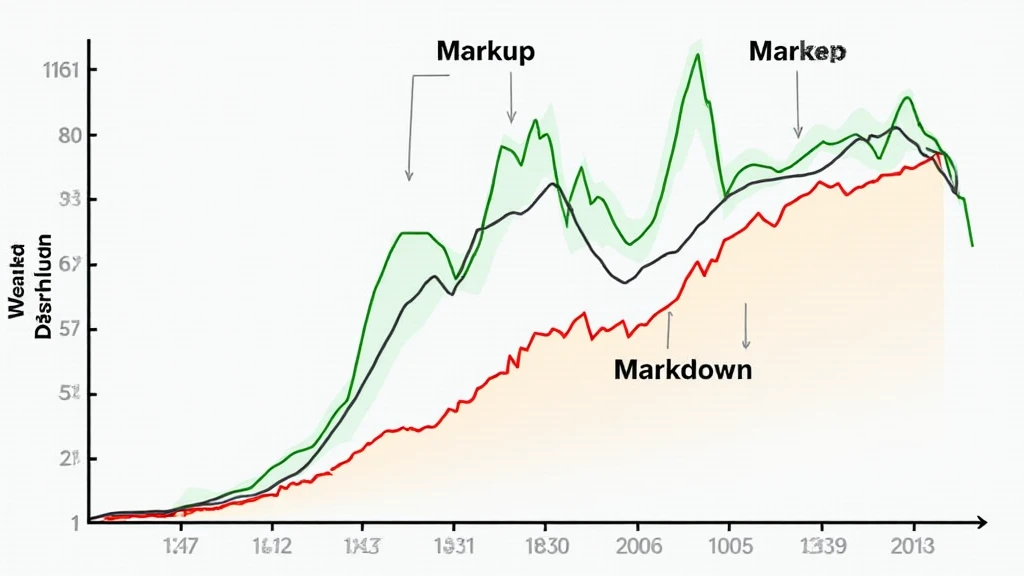

To predict market cycles effectively, it is important to understand the stages involved:

- Accumulation Phase: This phase occurs after a prolonged bear market. Investors begin to buy in at lower prices, leading to a slow build-up of demand.

- Markup Phase: Prices start to rise significantly during this phase as the influx of demand drives the price upwards. Media attention can also attract new investors, spurring excitement and market engagement.

- Distribution Phase: As prices peak, early investors begin to lock in profits, leading to increased selling pressure. This can create a false sense of security among new investors.

- Markdown Phase: The market faces a downturn as selling pressure outweighs buying interest. Prices drop, and investor sentiment turns negative.

2. Predicting Bitcoin Market Cycles: Tools and Techniques

Several methods can help investors predict where Bitcoin stands in its market cycle:

- Technical Analysis: Analyzing price movements and patterns can provide insights into future price behavior.

- Sentiment Analysis: Monitoring social media and news sources to gauge the current sentiment around Bitcoin can offer clues about its potential price action.

- On-chain Analysis: Assessing blockchain metrics such as transaction volumes and wallet addresses can indicate trends in market activity.

3. Historical Data and Trends

Understanding the history of Bitcoin’s price movements can help predict future cycles. For instance, the last bull market peaked in December 2017, followed by a significant downturn in 2018. Historically, Bitcoin tends to experience halving events approximately every four years, creating periods of spikes followed by corrections. This oscillation has led to annualized returns that far surpass traditional investments.

4. The Role of External Factors in Market Cycles

External factors can heavily influence Bitcoin’s market cycle:

- Regulatory Environment: Regions like Vietnam are seeing increased regulatory measures for cryptocurrencies. The growth rate of users from Vietnam has seen a notable increase, driving demand.

- Macroeconomic Trends: Global economic conditions, such as inflation rates or changes in interest rates, can affect investor behavior towards Bitcoin.

- Market Sentiment and News: Positive or negative news can sway public perception rapidly, impacting market movements significantly.

5. Expectations for 2025: Is it Time to Invest?

Looking ahead, predictions indicate that 2025 could be a transformative year for Bitcoin. According to various analysts, it is projected that Bitcoin might once again attain new all-time highs driven by continued institutional interest and technological advancements. The potential integration of cryptocurrencies into mainstream financial systems could present significant opportunities for investors.

Conclusion: Your Strategic Plan Moving Forward

In light of these predictions and historical trends, developing a strategic investment plan is essential. Whether the market heads into a bullish or bearish phase, being informed and prepared is key. Engage with reputable platforms like bitcoincashblender to help navigate the complexities of the market. As we forecast the upcoming cycles, remember that investing in Bitcoin carries risks, and it’s important to consult with financial advisors or local regulators before making significant decisions.

Meet the Expert

Dr. Alex Thompson is a renowned cryptocurrency analyst, having published over 25 articles in the blockchain domain. He has overseen audit projects for several well-known digital asset companies and continues to educate investors on market trends.