Introduction

As we navigate the evolving landscape of digital finance, Bitcoin microfinance emerges as a beacon of hope for millions in developing regions. In Vietnam, where many still lack access to traditional banking services, the integration of Bitcoin into microfinance offers new possibilities for economic advancement. With a staggering over 50% of the Vietnamese population unbanked, leveraging Bitcoin could enable a significant shift towards inclusive financial services.

This article aims to explore the intersection of Bitcoin and microfinance in Vietnam, examining its implications, benefits, and challenges. We’ll delve into local market data, analyze the current trends, and provide actionable insights for stakeholders looking to engage in this promising sector.

The Rising Importance of Microfinance

Microfinance is designed to provide financial services to those who lack access to traditional banking, and it’s particularly impactful in developing countries like Vietnam. Here’s how microfinance is currently functioning:

- Micro-loans: Small loans designed to help entrepreneurs start or grow their businesses.

- Financial literacy: Training programs that educate individuals about managing finances effectively.

- Insurance products: Affordable insurance options tailored for low-income households.

According to recent studies, microfinance institutions (MFIs) have significantly increased financial inclusion in Vietnam. As of 2023, MFIs serve over 7 million clients, showing a growth rate of 15% year-on-year. Traditional microfinance has transformed lives, but introducing Bitcoin could take this movement to the next level.

The Role of Bitcoin in Financial Inclusion

Bitcoin presents a unique opportunity for microfinance to scale new heights. Here’s why:

- Decentralization: Bitcoin operates on a decentralized network, removing the need for intermediaries and reducing transaction costs.

- Accessibility: All that’s needed is a smartphone and an internet connection to access Bitcoin, making it ideal in a country where many are unbanked.

- Low fees: Bitcoinal transactions have lower fees compared to traditional bank transfers, essential for micro-borrowers.

With the Vietnamese government actively promoting digital finance initiatives, the potential for Bitcoin in microfinance becomes increasingly evident. Institutions that adopt Bitcoin could enhance their operational efficiency and reach a more extensive customer base.

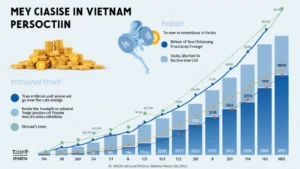

Market Data on Cryptocurrency Use in Vietnam

To truly appreciate the potential of Bitcoin microfinance, let’s look at some key market data:

| Year | Percentage of Vietnamese using Cryptocurrency | Growth Rate |

|---|---|---|

| 2021 | 20% | – |

| 2022 | 25% | 25% |

| 2023 | 35% | 40% |

According to various reports, the number of cryptocurrency users in Vietnam increased from 20% in 2021 to 35% in 2023. This growth indicates a rising acceptance of digital currencies, paving the way for innovative services like Bitcoin microfinance.

Challenges in Implementing Bitcoin Microfinance

While the prospects seem bright, several challenges could hinder the implementation of Bitcoin microfinance in Vietnam:

- Regulatory hurdles: The Vietnamese government is still formulating regulations surrounding cryptocurrency, which could slow down adoption.

- Volatility: Bitcoin prices are volatile; this risk could deter potential microfinance clients who prefer stable currencies.

- Awareness and education: Many potential users may not understand how Bitcoin works or its benefits, necessitating extensive outreach efforts.

Addressing these challenges is crucial for the successful integration of Bitcoin into Vietnam’s microfinance sector. Effective education campaigns and a cooperative relationship with regulators could foster a sustainable environment for growth.

Case Studies: Successful Implementations of Bitcoin Microfinance

Several entities globally are exploring or have implemented Bitcoin microfinance models. Here are a few examples worth noting:

- BitPesa: A company that allows individuals in Africa to send money across borders using Bitcoin, significantly reducing remittance costs.

- Celo: A blockchain-based platform providing an accessible mobile wallet designed for developing countries.

These case studies highlight successful models that can be adapted and implemented in Vietnam. Adaptations to local culture, regulations, and economic conditions are essential for success.

Future Outlook of Bitcoin Microfinance in Vietnam

The future looks promising for Bitcoin microfinance in Vietnam, especially with increasing internet penetration and smartphone usage. Here’s what the roadmap might look like:

- Increased blockchain education: As awareness grows, educational programs on blockchain technology will become more prevalent.

- Stronger regulatory framework: As the government finalizes its stance on cryptocurrencies, a clearer legal framework will encourage investment and innovation.

- Partnership opportunities: Collaboration between fintech companies and traditional MFIs could create seamless integration of Bitcoin microfinance services.

As these elements converge, we anticipate Bitcoin will play an increasingly critical role in boosting economic growth and financial inclusion in Vietnam.

Conclusion

In conclusion, Bitcoin microfinance offers a revolutionary approach to addressing the financial needs of unbanked and underbanked individuals in Vietnam. With its potential to minimize costs, enhance accessibility, and promote financial inclusion, stakeholders must overcome current challenges to maximize its impact. The Vietnamese market represents a fertile ground for such innovations, and with the right strategies in place, we anticipate significant growth and development in this sector.

As we explore this new frontier in finance, it’s crucial to ensure that we lay down a solid foundation based on education, regulation, and sustainable practices. We are just beginning to unlock the potential of Bitcoin in microfinance, and the journey ahead looks incredibly promising.

For those looking to navigate the Bitcoin landscape effectively, don’t forget to check out Bitcoin Cash Blender for insights and tools that can help you thrive in this exciting industry.

— Nguyen Minh Hoang, Blockchain and Microfinance Expert with over 15 published papers and lead auditor of well-known projects.