Introduction

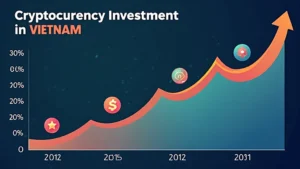

With the rise of Bitcoin and its ever-changing market dynamics, understanding effective trading strategies has become essential. In Vietnam, the interest in cryptocurrency is booming, with a reported 100% increase in users over the past year. This article will present various Bitcoin options strategies suitable for traders and investors in Vietnam, detailing their mechanics, benefits, and risks while integrating local market data and insights.

What are Bitcoin Options?

Bitcoin options are financial derivatives that give traders the right, but not the obligation, to buy or sell Bitcoin at a predetermined price within a specified time frame. This unique characteristic allows traders to create diverse strategies that can bolster their trading outcomes.

Types of Bitcoin Options

- Call Options: These options allow you to buy Bitcoin at a set price, which can be profitable if the market price increases.

- Put Options: These options allow you to sell Bitcoin at a predetermined price, which can protect against market declines.

Why Use Bitcoin Options Strategies?

In the context of Vietnam’s rapidly growing crypto market, employing effective options strategies can provide multiple advantages:

- Risk Management: Options can be used as a hedge against price declines, safeguarding your investments. For instance, if you own Bitcoin, you can purchase put options to minimize potential losses.

- Profit from Volatility: Options allow traders to profit from significant market movements without holding the underlying asset directly.

Popular Bitcoin Options Strategies for Vietnamese Traders

Here are some commonly used strategies adapted for the Vietnamese market:

1. Covered Call Strategy

This strategy involves owning Bitcoin while selling call options against your holdings. This allows traders to earn premium income from the sold options while still being exposed to potential profits from Bitcoin appreciation.

2. Protective Put Strategy

As mentioned earlier, a protective put strategy involves purchasing put options to guard against substantial price downturns. This is highly beneficial for investors in Vietnam who want to protect their investments during volatile market conditions.

3. Straddle Strategy

A straddle involves buying both call and put options at the same strike price. This strategy is ideal for profiting from significant price movements in either direction, which is common in the crypto market.

Understanding Local Market Conditions

Vietnam’s Bitcoin market is influenced by several factors, including regulatory developments and local investor sentiment. Research shows a notable 30% growth in retail investors in the crypto domain, indicating increasing interest and participation.

Future of Bitcoin in Vietnam

With the ongoing digital transformation, Bitcoin is likely to gain more traction in Vietnam, especially among younger demographics and tech-savvy individuals. Understanding Bitcoin options strategies will empower Vietnamese traders to navigate this evolving landscape more effectively.

Conclusion

By leveraging Bitcoin options strategies, traders and investors in Vietnam can enhance their trading outcomes while managing risks. As Vietnam’s cryptocurrency landscape continues to develop, integrating these strategies will be pivotal to achieving success. Remember to stay updated on the latest market trends and continuously refine your strategies.

Join the growing community of informed traders leveraging Bitcoin options for better outcomes. Explore your options, evaluate your strategies, and dive into the vibrant world of cryptocurrency.

Disclaimer

This information is not financial advice. Consult local regulators and conduct thorough research before engaging in trading activities.