Introduction

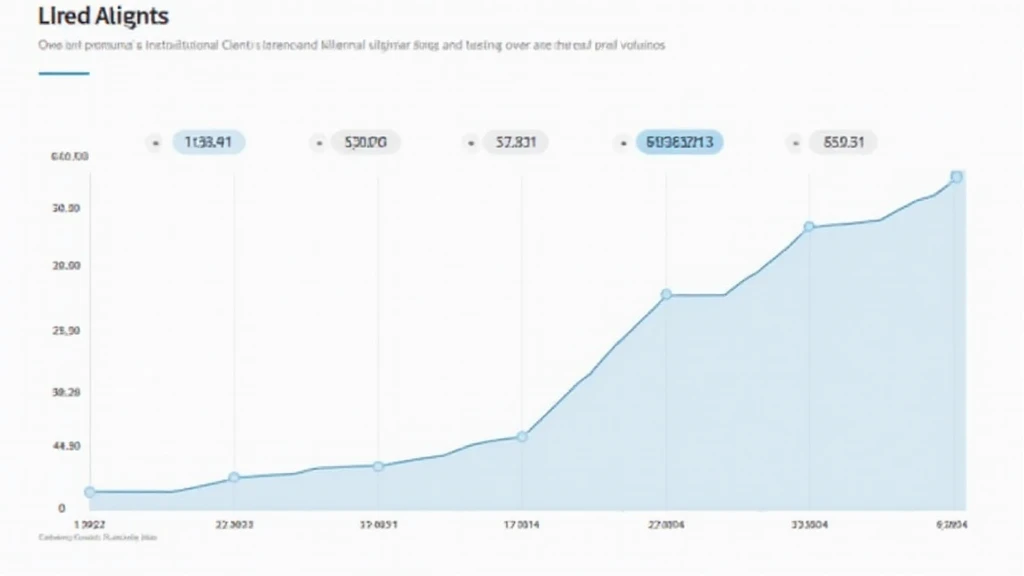

Coinbase has been making waves in the cryptocurrency world with its rapid growth in the institutional client sector. As of 2024, research indicates that institutional investments in cryptocurrencies reached unprecedented levels, accounting for over 60% of total market capitalization. With the loss of $4.1B due to DeFi hacks in 2024, institutions are looking for secure ways to enter the crypto space, leading to spikes in inquiries and investments in platforms like Coinbase. This article delves into the factors contributing to Coinbase’s institutional client growth, the strategic measures being undertaken, and what lies ahead for both Coinbase and the broader cryptocurrency market.

The Rise of Institutional Investors

In recent years, there has been a notable shift in the perception of cryptocurrencies. Once seen primarily as a speculative investment, institutional clients are increasingly recognizing the potential of digital assets as a long-term investment strategy. Here’s what’s happening:

- Increased Adoption: As more institutions are adopting cryptocurrencies as part of their asset management strategies, there has been a significant increase in Coinbase’s institutional client base.

- Secure Trading: Institutional clients prioritize security, which makes Coinbase’s comprehensive security measures appealing. With adherence to tiêu chuẩn an ninh blockchain, Coinbase has managed to build trust among its users.

- Regulatory Compliance: Coinbase is committed to adhering to regulatory standards, resulting in building long-term partnerships with institutions.

Factors Driving Coinbase’s Growth Among Institutional Clients

Several key factors have contributed to the burgeoning growth of Coinbase’s institutional client segment:

- Institution-specific Products: Coinbase has developed tailored products designed to meet the unique needs of institutional investors, which has helped in attracting more clients.

- Enhanced Customer Support: A dedicated team that understands institutional needs provides specialized support, increasing client satisfaction and retention.

- Global Expansion: Coinbase has been expanding its services globally, with a significant focus on emerging markets, including Vietnam, where crypto adoption among institutions has surged.

Localized Growth in Vietnam

Vietnam is witnessing a remarkable surge in crypto interest, with reports from local exchanges showing a 350% increase in new accounts opened in 2023 alone. Institutions in Vietnam are eager to tap into the crypto market, capitalizing on lower penetration rates compared to Western markets. This signifies a golden opportunity for Coinbase:

- Partnerships with Local Firms: Collaborations with local financial institutions could accelerate Coinbase’s presence in the Vietnamese market.

- Educational Initiatives: Coinbase can enhance institutional client onboarding through targeted educational workshops about cryptocurrency investments.

The Importance of Regulatory Compliance

Regulatory factors play a pivotal role in the growth of Coinbase’s institutional client base. Institutions are more likely to invest in environments that exhibit clear regulations, reducing legal risks. Coinbase has proactively engaged with regulators to ensure compliance:

- Transparency: Institutions look for transparency in dealings. Coinbase’s reporting practices boost trust significantly.

- AML and KYC Compliance: Adherence to Anti-Money Laundering (AML) regulations and Know Your Customer (KYC) protocols is essential in attracting institutional clients.

Conclusion

Coinbase’s strategic approach to institutional client growth is a clear reflection of changing trends in the cryptocurrency space. With increased security measures, localized strategies like targeting the Vietnamese market, and strong regulatory compliance, they are poised for continued success. As institutional interest in cryptocurrencies continues to grow, platforms like Coinbase will play a critical role in shaping the future of digital asset investments.

For those looking to navigate their way through the burgeoning world of digital assets, leveraging Coinbase could be a sound choice.

About the Author:

Dr. Alex Raymond is a blockchain technology expert and has authored over 20 research papers in the field of digital assets and institutional investment strategies. He has led audits for numerous prominent projects, establishing his authority in the cryptocurrency domain.