Introduction

In recent years, the crypto landscape in Vietnam has been evolving rapidly, with the country witnessing significant growth in digital asset investments. According to the latest reports, Vietnam ranks as one of the top countries in Southeast Asia for cryptocurrency adoption, with over 5 million users engaging daily. But as the popularity of cryptocurrencies grows, so does the need for robust trading techniques to navigate this volatile market. With billions lost to hacks and scams, it’s imperative to understand the safest and most effective crypto trading techniques Vietnam offers.

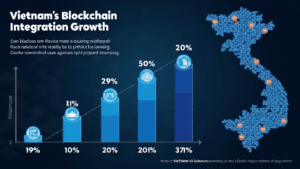

Understanding the Vietnamese Crypto Landscape

Vietnam’s crypto market has become a hub for both beginners and seasoned traders. The increasing user growth rate indicates strong interest but also highlights the necessity for knowledge about security standards in trading.

- Regulatory Environment: Although the Vietnamese government has implemented regulations, the crypto market remains largely unregulated, creating opportunities and risks.

- User Adoption: Over 7% of Vietnam’s population is estimated to be involved in cryptocurrency trading, particularly popular among the younger demographic.

Key Trading Techniques for Success

Effective trading requires a blend of strategies, fundamental analysis, and technical skills. Let’s explore several crypto trading techniques relevant in Vietnam.

1. Fundamental Analysis

Understanding the fundamentals of cryptocurrencies helps traders make informed decisions. Researching projects, their use cases, and the teams behind them can provide insights into their potential growth.

- Market Trends: Keep an eye on market trends to determine which cryptocurrencies are gaining traction.

- Project Whitepapers: Always read the whitepapers of projects you are considering investing in.

2. Technical Analysis

Technical analysis involves analyzing price charts and using indicators to forecast future price movements. Tools like Moving Averages and RSI (Relative Strength Index) are widely used among traders.

- Chart Patterns: Familiarize yourself with patterns such as Head and Shoulders or Pennants to make educated predictions.

- Volume Analysis: Understand trading volume trends to gauge the strength behind price movements.

3. Risk Management Techniques

Managing risk is crucial in crypto trading. Without a robust risk management strategy, traders can face significant losses.

- Setting Stop-Loss Orders: Limit your potential loss on any given trade by setting stop-loss orders based on your risk tolerance.

- Diversification: Spread your investments across various assets to minimize risk.

4. Leverage Trading

Using leverage can amplify your gains but also your losses. It’s essential to use this technique cautiously and understand how margin trading operates in the Vietnamese market.

5. Market Sentiment Analysis

Monitoring community sentiment on social media platforms like Facebook and Telegram can provide valuable insights into market movements.

- News Impact: Significant news events can lead to price fluctuations; thus, stay updated on global crypto news.

- Community Feedback: Engage with local Vietnamese crypto communities to stay informed about the latest trends.

Pros and Cons of Crypto Trading in Vietnam

Every market has its advantages and challenges. Here’s a breakdown of what to consider:

Advantages

- Growing User Base: With an increasing number of users, opportunities for profit in crypto trading are multiplying.

- Low Entry Barriers: Many platforms allow for small investments, making it easier for newcomers to start trading.

Challenges

- Volatility: The cryptocurrency market is notorious for its price swings, which can pose risks.

- Lack of Regulations: The absence of clear regulations may expose traders to fraud and scams.

Future Prospects of the Vietnamese Crypto Market

The future looks promising for cryptocurrencies in Vietnam. With technological advancements and increasing acceptance, we can expect further adoption in 2025 and beyond.

Emerging Trends

- Decentralized Finance (DeFi): The DeFi sector is gaining traction; studies suggest a potential market growth rate of 50% in the coming years.

- NFT Market Expansion: The rise of non-fungible tokens (NFTs) is attracting artists and investors alike.

Conclusion

As the crypto trading techniques in Vietnam continue to evolve, staying informed about market changes and adopting strategic approaches is essential for success. Whether you are a seasoned trader or a beginner, implementing these techniques will provide you with a strong foundation for navigating this dynamic environment. Crypto trading can be challenging, but with the right knowledge, you can protect your investments and seize profitable opportunities.

For more tools and up-to-date insight into trading techniques, consider utilizing resources like hibt.com. Remember, as always, this information is not financial advice. Consult local regulators before making investment decisions.

Author: Dr. Nguyen Thanh, 10+ published research papers on blockchain technology, leader in auditing several prominent crypto projects.