Introduction

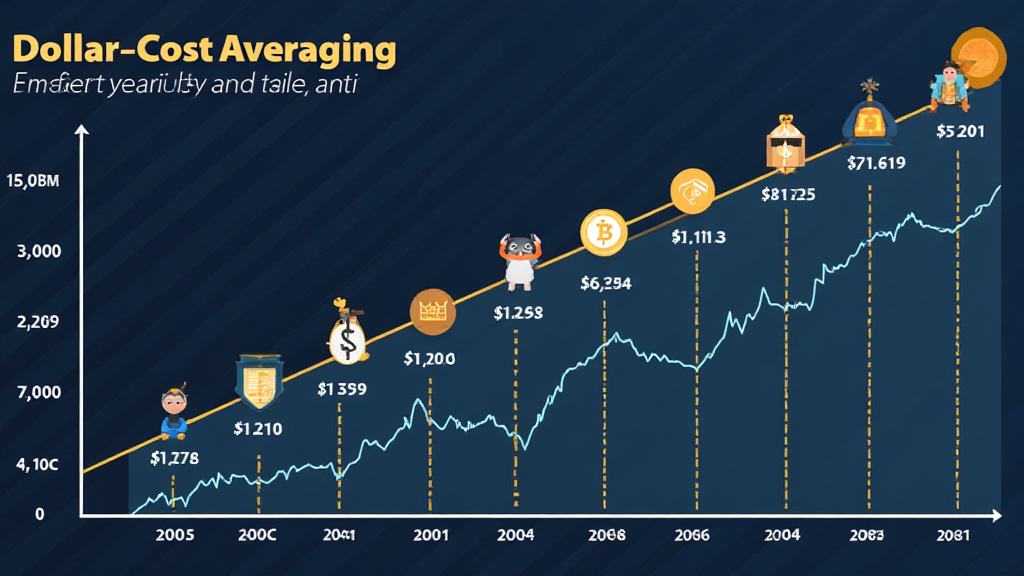

In the rapidly evolving landscape of cryptocurrency, strategizing your investments is paramount. With an estimated $4.1 billion lost to various forms of DeFi hacks in 2024, this highlights the importance of adopting a structured approach to investing in Bitcoin. This is where the DCA (Dollar-Cost Averaging) strategy comes into play. In this article, we dive into the DCA Bitcoin strategy for the 2026 cycle, aiming to provide valuable insights for both seasoned investors and newcomers alike.

Understanding the DCA Strategy

The Dollar-Cost Averaging strategy is simple yet effective. It involves investing a fixed amount of money into Bitcoin at regular intervals, regardless of its price. This approach mitigates the risks associated with market volatility. Here’s how it works:

- Consistency: By investing at regular intervals, such as weekly or monthly, investors can avoid the pressure of making high-stakes decisions based on short-term market fluctuations.

- Risk Mitigation: DCA reduces the impact of volatility on the overall investment. By spreading purchases over time, investors buy Bitcoin at different price points.

- Long-Term Vision: DCA aligns with a long-term investment strategy, making it suitable even during market downturns.

This strategy is particularly relevant as we approach the next cycle in 2026, where market dynamics may shift significantly.

Why Now is the Time to Start DCA

The 2026 market cycle presents unique opportunities for investors. According to recent reports, the user growth rate in Vietnam’s cryptocurrency market has surged by 250% since 2023. This spike indicates a burgeoning interest in digital assets, making it an opportune moment to consider a DCA strategy. Here are a few reasons to act now:

- The market is still in a relatively nascent stage, especially in emerging markets like Vietnam, where understanding of blockchain and cryptocurrency is growing.

- Bitcoin halving is projected for 2024, likely resulting in price appreciation in the following years. Positioning oneself early through DCA can yield significant returns.

- Market sentiment is gradually becoming more favorable, leaving less room for panic-induced sell-offs typical in bear markets.

Setting Your DCA Strategy

To successfully implement a DCA strategy for Bitcoin, you need to set specific parameters. Here’s a breakdown of key elements to consider:

1. Define Your Investment Amount

Decide how much you’d like to invest periodically. A common practice is to allocate anywhere between $50 to $500 based on your financial capacity and investment goals.

2. Choose Your Investment Frequency

Determine whether you want to invest weekly, bi-weekly, or monthly. This will depend on personal financial habits and cash flow.

3. Select Your Buying Platform

Choose a reputable cryptocurrency exchange with low fees and robust security measures. Platforms like Hibt.com provide excellent DCA features.

Benefits of DCA in the 2026 Cycle

Adopting a DCA strategy aligns perfectly with the anticipated trends of the 2026 crypto cycle. Here are some benefits:

- Simplified Decision-Making: By investing consistently, you eliminate the stress of timing the market, which can often lead to poor decision-making.

- Emotional Control: DCA helps maintain discipline and reduces emotional investments during price surges or falls.

- Compounding Gains: Regular investments can lead to accumulating more potential gains over an extended period.

Navigating Market Volatility: A Case Study

Let’s analyze a theoretical scenario demonstrating DCA’s effectiveness. Suppose you started investing in Bitcoin weekly from January 2022 to December 2024. Here’s a simplified investment table:

| Week | Investment ($) | BTC Price ($) | BTC Purchased |

|---|---|---|---|

| 1 | 100 | 40,000 | 0.0025 |

| 2 | 100 | 35,000 | 0.002857 |

| 3 | 100 | 30,000 | 0.003333 |

| 4 | 100 | 40,000 | 0.0025 |

| … | … | … | … |

Source: Hypothetical Market Data

By following DCA, your overall average purchase price lowers, allowing you to own more Bitcoin by the end of the investment period, showcasing the benefits effectively.

Integrating DCA with Other Strategies

While DCA is a solid standalone strategy, combining it with other investment practices can enhance overall returns. Here are some ideas:

- HODLing: Hold onto your Bitcoin for the long term, which can be beneficial in a bullish market.

- Trading Techniques: Periodically assessing market conditions allows you to allocate extra funds during dips.

- Diversification: Explore investing a portion of gains into other cryptocurrencies or even traditional assets.

Conclusion

Implementing a DCA Bitcoin strategy for the 2026 cycle can be a wise choice in navigating the turbulent cryptocurrency landscape. With clear strategies in place, considering market opportunities, and focusing on emotional control, investors can leverage DCA to potentially enhance their portfolio significantly. As the Vietnamese cryptocurrency market continues to thrive, the prospects for Bitcoin investment appear promising.

We encourage you to explore your options and find the best DCA strategy that fits your investment philosophy. Remember, always consult with a financial advisor to ensure your strategy aligns with your personal financial goals.

For more insights on cryptocurrency strategies, visit bitcoincashblender.

About the Author

Dr. Alex Nguyen is a blockchain technology expert with over 15 published papers in the field. He has led audits for several prominent projects and specializes in streaming data protocols. His insights in the cryptocurrency domain have helped shape current investment strategies.