Ethereum Real Estate: Understanding Consensus Algorithms

With the rapid growth of blockchain technology in real estate transactions, it’s essential to understand the consensus algorithms that power Ethereum. In 2024, the global real estate market faced disruptions due to emerging technologies, with a valuation exceeding $3 trillion. So, what does it mean for property transactions, and how can we take advantage of these innovations?

The Rise of Ethereum in Real Estate

Ethereum has become a cornerstone for various decentralized applications, especially in the real estate sector. Its smart contract capabilities allow for secure, transparent, and efficient property transactions. According to a report by Hibt.com, Ethereum-based real estate platforms have seen a 120% user growth in Vietnam alone as more investors turn to digital assets.

Understanding Blockchain Security Standards

The security of blockchain is paramount in real estate transactions. When dealing with assets worth millions, adopting the right tiêu chuẩn an ninh blockchain is crucial. These standards ensure that all transactions are secure and that users have confidence in the platform.

Consensus Algorithms Explained

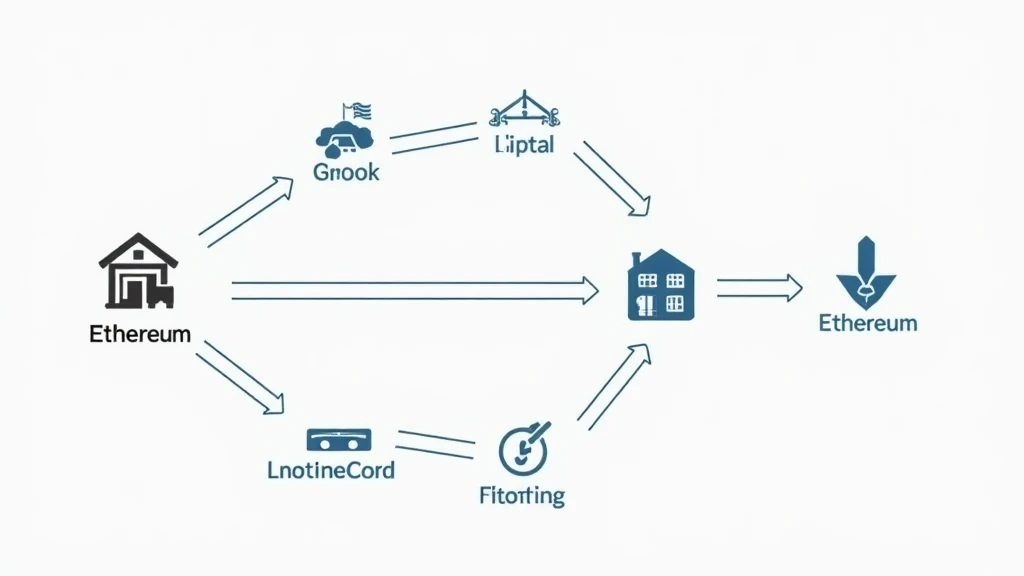

To understand how Ethereum continues to innovate, we need to break down its consensus mechanisms. These algorithms dictate how transactions are validated and added to the blockchain, ensuring that all participants agree on the current state of the ledger.

- Proof of Work (PoW): Initially used by Ethereum, requiring extensive computational power, leading to environmental concerns.

- Proof of Stake (PoS): Adopted in Ethereum 2.0, allowing users to validate transactions based on the amount of cryptocurrency they hold.

Both mechanisms have their strengths and weaknesses. For instance, PoW is more secure but often criticized for its energy consumption. In contrast, PoS is more sustainable but raises questions about centralization. Hence, companies in the real estate sector must choose their platforms wisely.

Potential Vulnerabilities in Consensus Mechanisms

Every consensus algorithm comes with vulnerabilities. For instance:

- 51% attacks in PoW, where a group controlling a majority of power can manipulate transactions.

- Staking centralization in PoS, where wealthier individuals control a significant portion of the network.

Like a bank vault for digital assets, understanding these vulnerabilities is crucial for security in the real estate market.

The Future of Ethereum in Real Estate Transactions

With the rise of NFTs and fractional ownership, Ethereum is set to reshape how real estate transactions occur. In Vietnam, local startups are developing platforms that allow users to buy shares of property, making real estate investment accessible to the masses.

Legislative Considerations

Regulations play a significant role in blockchain’s integration into real estate. Countries must adapt their legal frameworks to accommodate blockchain transactions effectively. As reported, over 18% of Vietnamese investors are unaware of existing crypto regulations, indicating a significant need for increased awareness and education.

Practical Applications of Ethereum in Real Estate

The practical applications of Ethereum’s consensus algorithms in real estate include:

- Smart contracts for automatic transfers of ownership.

- Transparent record-keeping for property history, ensuring trust and clarity.

- Fractional ownership models, allowing multiple stakeholders in investments.

Tools such as the Ledger Nano X help reduce hacks by approximately 70%, making property transactions safer than ever.

Conclusion: Embracing the Future with Confidence

As we look to the future, Ethereum’s integration with the real estate industry stands to offer unprecedented levels of transparency and security. Understanding consensus algorithms, along with their implications, will help investors make informed decisions in this evolving landscape.

With the projection of Ethereum‘s market capitalization reaching $500 billion by the end of 2025, aligning with reliable platforms like bitcoincashblender is key for anyone interested in investing in blockchain real estate.

Authored by Dr. Elizabeth Wright, a blockchain technology expert and author of over 15 papers on cryptocurrency and real estate integration.