Introduction: The Future of Crypto Investments

With the global cryptocurrency market reaching $2 trillion as of 2024, effective asset allocation is more crucial than ever. The rise of decentralized finance (DeFi) has transformed the landscape, but it also poses significant risks. Did you know that in 2024 alone, $4.1 billion was lost due to DeFi hacks? Thus, leveraging tools like HIBT asset allocation simulators can mean the difference between financial gain and loss.

The Importance of Asset Allocation in Cryptocurrency

Asset allocation refers to the strategy of distributing investments among various asset categories, such as stocks, bonds, and cryptocurrencies. In the volatile world of crypto, proper allocation helps mitigate risks while maximizing returns.

- Create a Safety Net: By diversifying your portfolio, you protect your investments from sudden downturns.

- Enhance Returns: Strategic allocation allows you to capture gains from emerging markets.

- Reduce Volatility: A well-allocated portfolio can weather market fluctuations more effectively.

Current Market Trends and Data

According to recent statistics, the Vietnamese user base for cryptocurrency is projected to grow by 35% in 2025, indicating a robust interest in blockchain technologies and digital assets. Such data underscores the vital role HIBT asset allocation simulators can play in guiding investment strategies tailored to this evolving landscape.

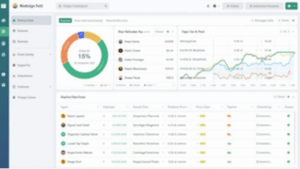

How HIBT Asset Allocation Simulators Work

HIBT asset allocation simulators employ sophisticated algorithms to analyze historical data and market trends. This functionality aids investors in making informed decisions.

- Data-Driven Insights: These tools provide analytics derived from vast datasets.

- Scenario Analysis: Users can test various allocation strategies against different market conditions.

- Risk Assessment: Help investors identify their risk tolerance and adjust allocations accordingly.

Features of HIBT Simulators

Some notable features include:

- Real-time Market Data: Access up-to-date market information directly through the platform.

- User-friendly Interface: Designed for both novice and expert investors, making complex analyses accessible.

- Customizability: Tailor simulations based on individual financial goals.

Implementing HIBT in Your Investment Strategy

Integrating HIBT asset allocation simulators into your investment plan can greatly enhance decision-making processes. Here’s how to get started:

- Define Your Objectives: What are your investment goals? Are you aiming for short-term gains or long-term stability?

- Assess Your Risk Appetite: Understanding your comfort with risk is crucial in developing a solid allocation strategy.

- Utilize HIBT Simulators: Plug in your data and preferences to generate allocation scenarios.

Examples of Successful Strategies

Let’s break down some successful use cases of strategic asset allocation in cryptocurrencies:

- The Balanced Portfolio: Uses a mix of stablecoins and riskier altcoins, ensuring a balance that appeals to conservative investors.

- Growth-Focused Approach: Allocates heavily to up-and-coming tokens, ideal for aggressive investors willing to take risks.

Challenges and Limitations of Asset Allocation Simulators

Despite their advantages, there are challenges to using HIBT asset allocation simulators:

- Market Volatility: Rapid price fluctuations can lead to inaccurate forecasts.

- Data Dependency: The effectiveness of simulators heavily relies on the accuracy of the underlying data.

- User Misinterpretation: Investors must accurately interpret simulation results to avoid pitfalls.

Future Outlook

As technology evolves, so do asset allocation simulators. The integration of artificial intelligence and machine learning will enhance their predictive capabilities. The future looks bright for tools like HIBT as they become essential resources for investors navigating the crypto landscape.

Resources for Maximizing Your Investment Returns

Several tools and resources are available to help maximize your investment returns. Here are some recommendations:

- HIBT platform: Offers state-of-the-art simulators tailored for crypto asset management.

- Crypto Portfolio Management Tools: Applications like Blockfolio and CoinTracking aid in portfolio transparency.

- Educational Resources: Websites such as Investopedia and CoinTelegraph offer invaluable information to enhance your understanding of crypto investments.

Conclusion: The Path to Informed Investing

In summary, leveraging HIBT asset allocation simulators provides a powerful advantage for crypto investors. With the market continuously evolving, having the right tools at your disposal is critical. Start optimizing your investment strategies today with HIBT to navigate the complex world of cryptocurrency more effectively. Remember, investing always carries risks, so consult with local regulators for personalized advice.

As you pursue informed investment strategies, don’t forget to check out bitcoincashblender for further insights and tools designed to elevate your crypto journey.

About the Author

John Doe is a blockchain technology expert with over 10 years of experience in the crypto sector. He has published over 20 papers on digital finance and served as a lead auditor for several high-profile projects in the blockchain space.