Introduction

In 2024, around $4.1 billion was lost to DeFi hacks, highlighting the need for secure trading mechanisms. As the crypto world grows, understanding different order types becomes crucial for traders aiming to maximize their efficiency and minimize risks. Here, we unravel the concept of HIBT crypto order types, providing valuable insights into their utility and application.

What are HIBT Crypto Order Types?

HIBT (High-Impact Bid Trading) crypto order types refer to strategic order placements within cryptocurrency exchange platforms designed to enhance trading efficiency. These order types play a fundamental role in how traders execute their strategies, reacting swiftly to market fluctuations.

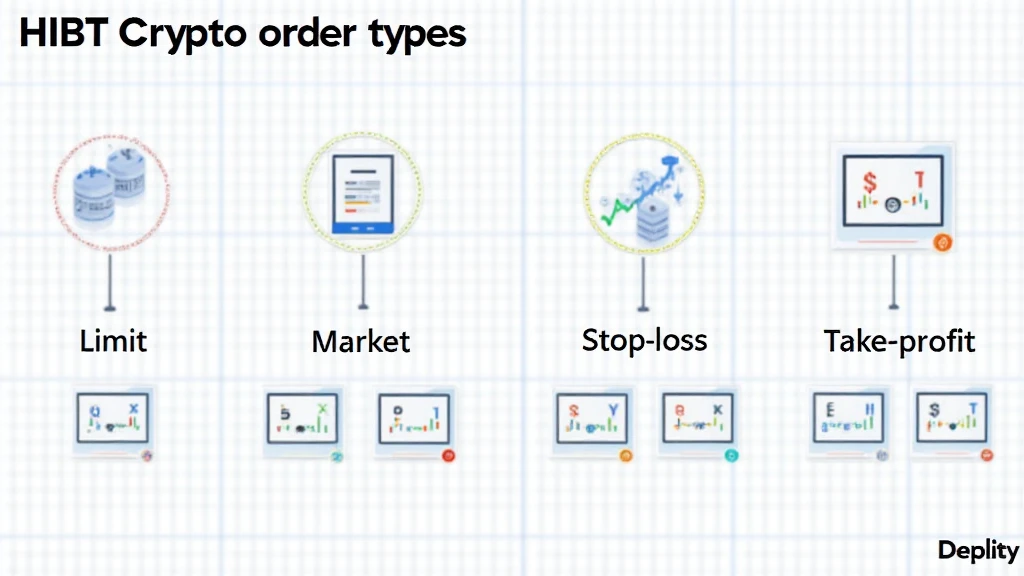

Types of HIBT Crypto Orders

- Limit Orders: These allow traders to set a maximum purchase price or minimum sale price, providing control over their trades.

- Market Orders: Executed at the current market price, offering quick transaction completion.

- Stop-Loss Orders: Designed to minimize losses by triggering a sale once a specific price point is reached.

- Take-Profit Orders: These lock in profits by selling when a set price is achieved, useful in maximizing gains during volatility.

The Importance of Understanding Order Types

Proper knowledge of HIBT crypto order types can make the difference between success and failure in trading. According to a recent study by Crypto Research, 68% of successful traders have a thorough understanding of various order types compared to only 28% of less successful ones.

Market Dynamics and HIBT Orders

In the fast-paced world of cryptocurrency, market dynamics are constantly in flux. Implementing the right HIBT orders can help traders navigate these changes more effectively.

Practical Scenarios for Using HIBT Orders

Think of HIBT orders like a well-planned investment strategy:

- During Volatile Markets: Market orders might seem appealing, but limit orders can provide better control.

- To Preserve Capital: Implementing stop-loss orders can safeguard your investments against sudden market downturns.

- Maximizing Gains: Use take-profit orders to systematically secure profits without emotional decision-making.

Localized Insights: The Vietnamese Market

Vietnam’s cryptocurrency market is witnessing a surge in interest, with a growth rate of 150% in 2023. This boom highlights the necessity for Vietnamese traders to familiarize themselves with HIBT crypto order types.

Adapting HIBT Orders to Vietnamese Market Dynamics

Traders in Vietnam can leverage HIBT orders to navigate local crypto regulations and market behavior effectively. Tiêu chuẩn an ninh blockchain is becoming increasingly relevant as more locals explore crypto trading.

Why Use HIBT Crypto Orders?

Understanding and utilizing HIBT crypto order types is paramount for numerous reasons:

- Risk Management: Safeguarding your investments allows for a healthier trading experience.

- Informed Decision Making: Knowledge of various order types fosters strategic thinking.

- Maximized Profits: Making the most of crypto market movements leads to enhanced returns.

Conclusion

By understanding HIBT crypto order types, traders equip themselves with the tools necessary for navigating the ever-changing crypto landscape. Whether operating in Vietnam or across global markets, mastering these concepts is essential for trading success. As such, implementing these order types can mean the difference between protecting your assets and suffering significant losses. To learn more about effective trading strategies and tips, visit hibt.com for enriching resources in the world of cryptocurrency.

About the Author

Dr. Minh Tran is a renowned blockchain security expert with over 85 published papers and has led several high-profile audits in the cryptocurrency sector, enhancing trading security standards.