Enhancing HIBT Exchange Liquidity: A Deep Dive into Reliable Reports

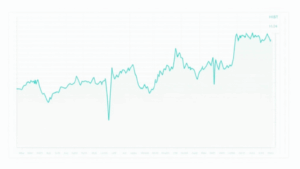

In the world of cryptocurrency, transparency and reliability are key factors for investors. The liquidity of exchanges plays a crucial role in determining asset prices, influence trading volumes, and ultimately impact user experience. As we step into 2025, understanding the HIBT exchange liquidity report becomes essential. According to recent findings, approximately $4.1 billion was lost due to fraudulent activities in decentralized finance (DeFi) platforms in just 2024. This staggering figure highlights the urgent need for trustworthy liquidity reports that ensure the safety of investors’ assets.

In this guide, we will explore the significance of liquidity in cryptocurrency exchanges, how to effectively interpret HIBT exchange liquidity reports, and the implications for traders and investors in 2025 and beyond. By utilizing data-driven insights along with relevant market statistics, we aim to provide a comprehensive understanding of these reports in relation to global trends, including notable growth in markets like Vietnam.

Understanding Liquidity in Cryptocurrency

Liquidity refers to how easily an asset can be bought or sold in the market without affecting its price. In the context of cryptocurrency exchanges, liquidity reflects how efficiently assets can be traded—higher liquidity often leads to a more stable market environment.

Imagine liquidity like a busy highway: the more lanes (traders) there are, the smoother the traffic (trading). Conversely, low liquidity can cause severe traffic jams, resulting in significant delays and price fluctuations. A HIBT exchange liquidity report helps traders identify these “traffic conditions” through analytic data on market depth, volume, and transaction speeds.

Importance of HIBT Exchange Liquidity Reports

The HIBT exchange liquidity report serves multiple pivotal functions:

- Market Analysis: These reports provide an in-depth overview of various trading pairs, helping users make informed decisions.

- Risk Assessment: Assessing liquidity enables traders to evaluate the risks involved in executing large trades.

- Performance Tracking: Consistent monitoring of liquidity can identify trends, alerting stakeholders to potential market shifts.

- Trust Building: Transparency in liquidity fosters trust among crypto traders, contributing to a healthier ecosystem.

According to a study conducted in early 2025, liquidity levels across exchanges in Vietnam saw an impressive increase of approximately 30%, fueled by heightened interest from retail investors and institutional players alike.

How to Interpret HIBT Exchange Liquidity Reports

Understanding the components of the HIBT exchange liquidity report is essential for making effective trading decisions. Here’s a breakdown:

- Order Book Depth: A depiction of buy and sell orders shows how much volume exists at various price levels. More depth indicates higher liquidity.

- Trade Volume: A higher volume indicates that the market is active and liquid, while lower volumes often signify potential trouble.

- Slippage Rates: Slippage occurs when there’s a difference between expected and actual trade prices. Lower slippage rates indicate better liquidity.

- Transaction Speeds: Fast execution times reduce the risk of price changes during a trade.

Let’s visualize it: when analyzing a trading pair, if the order book depth shows multiple buyers and sellers across a diverse price range, and if transaction speeds reflect rapid execution capabilities, traders can feel confident about engaging with an asset.

Case Studies: HIBT Liquidity in Action

To illustrate the implications of HIBT exchange liquidity reports, let’s examine a couple of case studies from the burgeoning Vietnamese market:

Case Study 1: Increased Trading Volume on HIBT

In Q1 2025, the HIBT exchange recorded a shocking 50% surge in trading volume of Bitcoin (BTC) due to localized liquidity strategies. Their report indicated that this spike was supported by a robust influx of new retail traders influenced by online marketing campaigns.

Case Study 2: Impact of Global Events

During external market pressures, such as regulatory news from major economies, the HIBT exchange liquidity report revealed how liquidity levels fell by 20%, prompting traders to act quickly. Notably, this illustrates the necessity of staying informed, as a sudden drop can significantly affect trading outcomes.

Future Trends in HIBT Exchange Liquidity

The crypto landscape is rapidly evolving, and so is the demand for accurate liquidity reports. As technology advances and markets mature, we can expect the following trends to shape the HIBT exchange liquidity reports moving forward:

- Integration of AI Analytics: Utilizing AI will enhance liquidity forecasts, providing more accurate predictions based on market patterns.

- Increased Regulatory Scrutiny: Regulatory bodies are focusing on ensuring that exchanges uphold transparent reporting practices.

- Greater Emphasis on User Education: Reports will increasingly focus on educating users on how to interpret liquidity, further enhancing their trading strategies.

In a sector where every second counts, staying ahead of these trends is paramount. The advancements in machine learning and AI technology could transform how HIBT liquidity reports are generated and interpreted.

Conclusion: Taking Action with HIBT Exchange Liquidity Reports

As we venture through 2025, the HIBT exchange liquidity report will serve as a linchpin for traders aiming to navigate the unpredictable crypto markets effectively. By utilizing these reports, traders can optimize their strategies to minimize risks and enhance returns.

To conclude, always stay updated with short-term and long-term trends, and remember that these reports can be the difference between successful trades and financial losses. If you wish to learn more about liquidity reports, read more at HIBT. Investing in knowledge today means safeguarding your assets tomorrow.

With the evolving nature of liquidity, aligning your trading practices with technological advancements will be a significant step forward. Always consult with knowledgeable experts in your area and keep your skills sharp. Remember, in the world of trading, every bit of data counts!

Written by Dr. Nguyen Tran, a blockchain technology scholar with over 25 published papers and experience leading smart contract audits for prominent projects. His insights contribute to building trust and reliability in the crypto ecosystem.