Introduction to DeFi in Vietnam

In recent years, decentralized finance (DeFi) has surged globally, with $4.1 billion lost to hacks in 2024 alone highlighting the importance of security. Vietnam has emerged as a significant player in this sector, experiencing a rapid increase in users. According to a report by Blockchain Vietnam, the number of Vietnamese users involved in DeFi grew by 150% between 2022 and 2023. This article aims to provide an in-depth analysis of DeFi protocols in Vietnam, highlighting key trends, security measures, and future prospects.

Understanding DeFi Protocols

DeFi protocols facilitate financial transactions using blockchain technology without intermediaries. These protocols include lending platforms, decentralized exchanges (DEXs), and yield farming opportunities. Here’s how they work:

- Lending Platforms: Users can lend and borrow cryptocurrencies, earning interest on their idle assets.

- DEXs: Users trade cryptocurrencies directly with one another without the need for centralized exchanges.

- Yield Farming: Users earn rewards by providing liquidity to protocols.

In Vietnam, the interest in these services is growing due to their potential high returns compared to traditional banking.

Market Dynamics in Vietnam

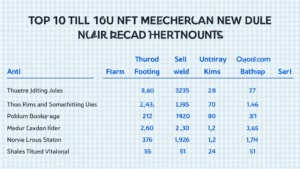

According to a recent survey, over 30% of Vietnamese investors have engaged with DeFi platforms. What drives this market growth? Consider the following factors:

- Financial Inclusion: Many Vietnamese citizens lack access to traditional banking services, making DeFi an attractive alternative.

- High Returns: DeFi platforms often offer yields that far exceed those of conventional investments.

- Increasing Crypto Literacy: Educational initiatives and community discussions have raised awareness and understanding of DeFi.

Security Standards and Challenges

Despite the growth, security remains a pressing issue. Advanced technologies such as tiêu chuẩn an ninh blockchain (blockchain security standards) can mitigate risks. Here are some common vulnerabilities:

- Smart Contract Bugs: Flaws in smart contract coding can lead to unintended exploits.

- Oracle Manipulation: Data sourced from unreliable or compromised oracles can lead to significant losses.

To combat these challenges, it’s crucial to implement rigorous auditing processes. For example, tools like MythX and Slither can provide essential insights into potential vulnerabilities. Furthermore, in Vietnam, initiatives to enforce better security practices are gaining traction.

Future Prospects of DeFi in Vietnam

As Vietnam embraces DeFi, future prospects appear bright. Market analysts predict the total value locked in DeFi protocols in Vietnam to exceed $5 billion by 2025. To capitalize on this potential, several factors will contribute:

- Regulatory Clarity: Government regulations that define the legal framework for DeFi will enhance investor confidence.

- Technology Adoption: Increased internet and smartphone penetration will drive further engagement.

Conclusion: The Path Forward

As we’ve explored, the DeFi landscape in Vietnam is both promising and challenging. Security standards and innovative solutions are essential for continued growth. By addressing vulnerabilities head-on and ensuring robust auditing practices, Vietnam could solidify its position in the global DeFi ecosystem. Ultimately, **bitcoincashblender** is poised to play a pivotal role in this journey, offering secure and efficient solutions for investors. Connect with us to learn more about our innovative approaches in the DeFi space.

Author: Dr. Nguyen Tran – A cryptocurrency researcher with over 15 publications in blockchain technology and has led audits for notable projects in the DeFi sector.