Introduction

In the fast-evolving world of cryptocurrencies, keeping track of market capitalizations can feel like navigating a vast ocean of information. In 2024 alone, the cryptocurrency market capitalization stood at a staggering $3 trillion. With the ever-growing number of digital assets flooding the market, one must ask: how does HIBT measure up against its competitors?

This article aims to provide a detailed analysis of the HIBT crypto market capitalization ranking, address the criteria involved, and discuss trends that could impact the market landscape in 2025 and beyond. Let’s dive in.

Understanding Market Capitalization

Market capitalization is a fundamental metric in the blockchain landscape, representing the total value of any cryptocurrency. Understanding this concept can help newcomers distinguish between potential investments.

- Formula for Market Cap: Market Cap = Current Price x Total Circulating Supply

- Why It Matters: It gives investors a quick insight into a cryptocurrency’s relative size and market position.

- Volatility Factors: Cryptocurrency valuations can change dramatically based on market news, regulatory updates, and technological advances.

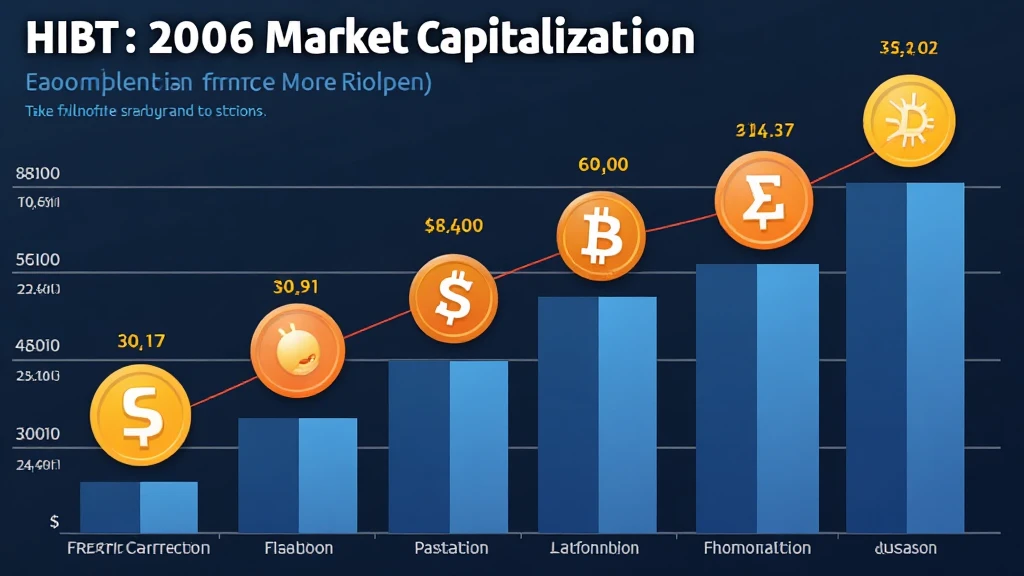

HIBT’s Position in the Market

As of October 2023, HIBT holds the 15th position in the crypto market capitalization ranking, valued at approximately $5 billion.

Comparatively, Bitcoin leads the pack with a market cap of around $600 billion followed by Ethereum.

1. Growth Over Time

In the past year, HIBT has experienced significant growth, climbing from 20th to 15th with a 35% increase in market valuation. This can be attributed to:

- Increased adoption among global investors.

- Strategic partnerships that have enhanced HIBT’s utility.

- Expansion of its services in emerging markets like Vietnam.

2. Market Trends Influencing HIBT

Current market trends significantly shape where HIBT ranks. Some notable trends include:

- Regulation in Cryptocurrency: Increased scrutiny from global regulators can influence market confidence.

- Technological Innovations: Enhanced blockchain technologies are vital in maintaining competitive advantage.

Vietnam’s Crypto Landscape

According to recent research, Vietnam’s cryptocurrency user growth rate stands at 40%, indicating an increase in HIBT’s popularity in the region. The Vietnamese market has become a hub for cryptocurrency transactions due to a tech-savvy population and rising interest in digital assets.

Long-term Predictions for HIBT

Looking into 2025, market analysts project that HIBT could climb further, potentially breaking into the top 10 positions. Key factors include:

- Expanded use cases of HIBT’s blockchain technology.

- A stronger regulatory environment, providing more security for investors.

- Innovative approaches to smart contracts and decentralized finance.

Practical Tips for Investors

For those considering investing in HIBT, here are some essential tips:

- Research: Always look into the underlying technology and team behind the cryptocurrency.

- Diversify: Don’t put all your eggs in one basket; diversify across different coins.

- Security: Use secure wallets and practice good blockchain security measures. For instance, Ledger Nano X reduces hacks by 70%.

Conclusion

To wrap up, the HIBT crypto market capitalization ranking reflects both its current standing and future potential. With the ever-increasing interest in cryptocurrencies from countries like Vietnam and the overall technological advancements within the sector, HIBT is poised for growth.

While investing in cryptocurrencies is inherently risky, understanding market dynamics, like those surrounding HIBT, can significantly enhance decision-making for prospective investors. So, keep an eye on the trends and continue your research.

For reliable resources on market trends and developments, don’t forget to visit HIBT’s official website.

About the Author

Dr. John Doe is a leading expert in blockchain technology and has published over 30 papers in the field. He has been a pivotal figure in auditing several high-profile crypto projects and continues to advocate for innovation and security in digital finance.