Vietnam Crypto Venture Capital Funding 2025: Trends and Predictions

As we move into 2025, the landscape for blockchain technology and cryptocurrency funding in Vietnam is rapidly evolving, capturing the attention of global investors. With an increase in digital asset adoption and a surge in innovation, the Vietnam crypto venture capital funding scene is projected to experience substantial growth. In this article, we will delve into the factors shaping this growth, including market statistics, investment trends, and regulatory developments, alongside a comprehensive understanding of Vietnam’s unique position in the global crypto market.

Understanding the Landscape of Crypto Venture Capital in Vietnam

The notion of venture capital within the cryptocurrency realm is often tinged with nuances that vary from region to region. The past few years have been pivotal for Vietnam, marked by a notable increase in cryptocurrency utilization among local users. Reports indicate that Vietnam ranks as one of the top countries globally in terms of cryptocurrency adoption, with an impressive user growth rate of over 400% in recent years.

- 2022: Cryptocurrency user population stood at approximately 5 million.

- 2023: Growth surged to about 20 million users.

This rapid adoption provides a fertile ground for venture capital investment, as more traditional investors look to capitalize on the burgeoning market. As we approach 2025, it’s essential to understand the factors that will influence further investment opportunities.

Key Drivers of Venture Capital Interest in Crypto

The appetite for venture capital funding in Vietnam’s crypto space can be attributed to several key drivers:

- Growing Start-up Ecosystem: The number of blockchain startups in Vietnam has tripled since 2021. Information from the Vietnam Blockchain Association indicates that there were approximately 300 blockchain startups by the end of 2023.

- Increased Institutional Interest: Traditional financial institutions and venture capital firms are beginning to explore blockchain technology. Many are backing startups that develop decentralized finance (DeFi) solutions and blockchain infrastructure.

- Regulatory Support: Recent regulatory developments from the Vietnamese government have aimed at creating a more secure and thriving environment for digital assets, fostering confidence among investors.

Vietnam’s Unique Position in the Global Crypto Market

Vietnam’s strategic positioning in Southeast Asia offers distinct advantages for crypto ventures:

- Technologically Savvy Youth: The country’s youth demographic, with a median age of 30 years, is driving the adoption of innovative technologies like blockchain.

- Favorable Demographics: Vietnam boasts a large population of tech-savvy individuals who are familiar with online transactions and digital currencies.

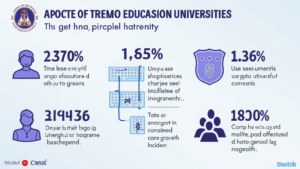

- Blockchain-Friendly Universities: Academic institutions across the country are integrating blockchain technology into their curriculum, producing graduates who are well-versed in the needed technology.

Investments Trends and Predictions for 2025

As we forecast into 2025, several trends and predictions can be highlighted:

- Sector-Specific Investments: Expect more capital directed toward sectors like DeFi, NFTs, and blockchain infrastructure.

- Increased Seed Funding Rounds: Early-stage investments in startups will continue to rise, as venture capital firms see substantial returns driven by rapid adoption.

- Partnerships with European and American Firms: Collaborations with international venture capitalists will bolster the funding environment, creating joint ventures that benefit local startups.

Challenges Facing Crypto Venture Capital in Vietnam

Despite the promising growth, several challenges may hinder the momentum:

- Regulatory Uncertainty: While regulations are improving, there remains a degree of uncertainty that may cause delays in investment decisions.

- Market Volatility: The volatile nature of cryptocurrencies can deter investors looking for stable returns.

- Infrastructure Development: The need for enhanced technological infrastructure to support further growth cannot be overlooked.

The Path Ahead: Navigating the Future of Crypto Funding in Vietnam

As we look toward 2025, the Vietnam crypto venture capital scene is poised to offer unprecedented opportunities for growth. Those interested in entering the market must navigate through both the burgeoning opportunities and the inherent challenges.

To stay informed and make strategic decisions, it’s essential to follow regional developments closely, assess market conditions, and incorporate local insights. This entails being aware of “tiêu chuẩn an ninh blockchain” (blockchain security standards) and other regulations that will shape the framework of investment activities.

Conclusion

Vietnam has emerged as a vibrant player in the global cryptocurrency landscape with its unique demographic advantages and an increasingly favorable investment climate. The Vietnam crypto venture capital funding scene in 2025 is likely to be characterized by increased investments across various sectors, strategic partnerships, and continued innovation. For potential investors and entrepreneurs, understanding the trends and maintaining adaptability in response to market conditions will be paramount to maximizing opportunities.

For more insights on navigating this dynamic landscape, consider exploring resources available at hibt.com and enhancing your knowledge of crypto investments. Not only can you prepare for a successful venture, but by employing tools like Ledger Nano X, you can secure your investments against potential hacks, which have reduced significantly since its introduction.

Disclaimer: Not financial advice. Consult local regulators and conduct thorough research before making investment decisions.

Expert Author: Dr. Minh Vu, a recognized thought leader in blockchain technology, has authored over 12 papers in the fields of digital assets and venture capital. He has been pivotal in auditing several high-profile crypto projects and remains a sought-after speaker at industry conferences.