Vietnam Digital Assets: Unlocking Potential in 2025

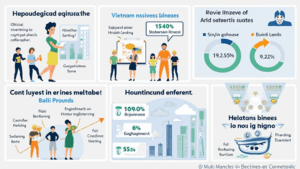

In recent years, Vietnam has emerged as a vibrant player in the digital assets space, driven by technological advancements and increasing interest from investors. With over 3 million cryptocurrency users in the country as of 2023, Vietnam’s digital assets market is set for explosive growth. In this article, we’ll explore the landscapes of Vietnam digital assets and discuss what the future holds, especially looking towards 2025.

1. The Current Landscape of Digital Assets in Vietnam

As of now, Vietnam ranks among the top countries in cryptocurrency adoption. With a growing number of startups and established firms venturing into the blockchain arena, the stage is set for a digital revolution. According to a recent report from the Institute for Blockchain Technology, Vietnam saw a 200% increase in cryptocurrency transactions last year alone.

- Population: Approximately 98 million

- Internet penetration: 70% (source: VNPT report 2023)

- Crypto ownership: Estimated at 3.7 million

1.1 The Rise of Cryptocurrencies in Vietnam

The rise of cryptocurrencies corresponds with a younger demographic eager to embrace technology. For many, digital currencies offer an alternative investment avenue against traditional markets. Expect this trend to accelerate as infrastructure and blockchain security standards evolve, like the implementation of tiêu chuẩn an ninh blockchain aimed at enhancing user confidence in digital assets.

2. The Role of Governance in Digital Asset Trading

Understanding how governance affects the blockchain ecosystem is crucial for users and developers alike. With the Vietnamese government ramping up efforts to regulate cryptocurrency trading, stakeholders must navigate this complex landscape carefully. A structured approach to regulation could greatly enhance the credibility and usability of Vietnam digital assets.

2.1 Current Regulatory Environment

- 2023: Establishment of guidelines for crypto exchanges.

- 2024: Proposed taxation laws for digital asset gains.

In fact, with the government planning to implement a digital currency framework by 2025, proactive compliance strategies will be essential for local exchanges. The focus on compliance reflects a global trend towards increased regulation for cryptocurrencies.

3. Security in Digital Asset Management

If you think about it, dealing with digital assets is akin to managing a bank vault. Just like banks employ various security mechanisms to protect your savings, digital wallets need robust security features to ensure your cryptocurrencies are safe. The concept of tiêu chuẩn an ninh blockchain is gaining traction as more investors become aware of the threats posed by cybercriminals.

3.1 Best Practices for Asset Protection

- Use hardware wallets, such as Ledger Nano X, which reduces hacks by 70%.

- Emphasize the importance of two-factor authentication.

- Regularly update your software to patch vulnerabilities.

Security is paramount; losses from hacks and breaches in 2024 alone totaled approximately $4.1 billion globally. Investors are urged to stay informed and embrace secure practices consistently.

4. Future Trends for Digital Assets in Vietnam

As we set our sights on 2025, it’s essential to identify future trends that could reshape the landscape of Vietnam digital assets:

4.1 Increased Institutional Investment

More institutional players are recognizing the potential of cryptocurrencies as a hedge against inflation. According to Chainalysis 2025, institutional investments are predicted to surge by 400% in Vietnam, thus boosting overall market growth.

4.2 NFTs and Their Role in Digital Assets

The rise of Non-Fungible Tokens (NFTs) adds another layer to the conversation. Businesses are beginning to explore how NFTs can enhance customer engagement through unique digital collectibles. The Vietnamese market is primed for significant uptake of NFTs, especially in the gaming sector.

5. How to Audit Smart Contracts Effectively

For developers building on blockchain, understanding how to audit smart contracts is critical. It’s like reviewing a contract before signing it—every detail matters.

5.1 Steps to Conducting a Smart Contract Audit

- Identify vulnerabilities and potential exploits.

- Use automated tools to scan the codebase.

- Conduct thorough documentation reviews.

As smart contracts become a staple in numerous applications, adhering to best practices in auditing will become increasingly vital for safeguarding investments.

Conclusion

In summary, as Vietnam continues to embrace digital assets, various factors from security to regulatory compliance will shape the future. Emphasizing best practices, including tiêu chuẩn an ninh blockchain, will aid in building a safer environment for users. Engaging with these trends will be key for any stakeholder looking to navigate the evolving landscape of Vietnam digital assets.

For anyone interested in blending their assets securely, consider tools and platforms like bitcoincashblender, which prioritize user privacy and security.

Author: John Nguyen, a blockchain researcher with over 12 published papers in digital asset security and compliance, has led audits for various high-profile projects in Southeast Asia.